As gold prices continue to climb and economic uncertainty looms, more people are looking for affordable ways to invest in precious metals. One unconventional method gaining traction? Buying gold from a pawn shop.

For certain investors, buying gold from a pawn shop can be a smart way to access physical gold, potentially offering unique opportunities for diversification and value when approached carefully.

While pawn shops can offer surprising deals, they also come with their own set of risks. In this article, we’ll explore how to buy gold from a pawn shop, share cheap gold buying tips, and highlight key pawn shop bullion risks you should know before handing over your cash.

Why Consider a Pawn Shop to Buy Gold?

Pawn shops are no longer just for secondhand electronics and guitars — many now carry gold jewelry, coins, and even bullion. Here’s why some investors and collectors turn to them:

- Lower premiums compared to traditional bullion dealers

- Occasional discounts on scrap or secondhand gold

- Negotiation opportunities — many shops are open to haggling

- Quick and local access without waiting for shipping

- Variable costs — sometimes the costs at pawn shops can be lower than at other outlets, but they may also be higher if buyers are not careful

But keep in mind, these advantages come with tradeoffs — especially in terms of quality assurance and authenticity. Unlike reputable dealers, pawn shops may not always provide the same level of transparency or guarantee when purchasing gold, so it's important to consider the reputation of the seller.

Ultimately, purchasing gold from a pawn shop requires careful consideration of both the potential advantages and the risks involved.

What Types of Gold Do Pawn Shops Sell?

You may not find a full bullion inventory at your local pawn shop, but you might come across gold bullion—physical gold in the form of bars or coins, typically meeting high purity standards and sourced from reputable mints or refiners.

- Gold Jewelry (typically 10K to 22K, often without paperwork)

- Gold Coins like Krugerrands, American Eagles, or older numismatics; some coins have an official face value, which is marked on the coin and can affect their legal status and resale value

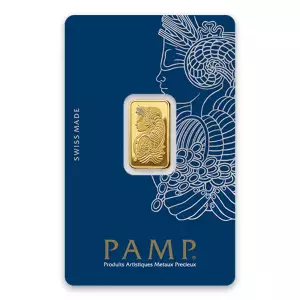

- Gold Bars — though rarer, sometimes pawn shops get small bars; always check for pure gold (such as 24K or 99.9% purity) to ensure authenticity and value

- Scrap Gold — broken pieces or parts sold for melt value

Always inspect each item closely and verify what karat and weight you’re buying.

Cheap Gold Buying Tips: How to Spot a Good Deal

Looking to save money while buying gold at a pawn shop? These cheap gold buying tips can help you avoid overpaying or getting scammed when buying physical gold—follow these tips to make a secure and informed purchase.

Know the Spot Price

Check live gold prices online before entering the shop so you know the real-time value.

Bring a Gold Testing Kit

Some pawn shops allow testing — look for acid tests or handheld scanners to confirm karat.

Weigh It Yourself

Use a digital scale (in grams or troy ounces) to verify weight. Double-check the store’s measurements.

Calculate Melt Value

Figure out what the gold is actually worth based on weight and purity, then compare to their asking price. Understanding the intrinsic value of gold helps buyers avoid overpaying and ensures you recognize the true worth of your purchase.

Ask for a Better Price

Many pawn shops expect buyers to negotiate. Don’t accept the first number they give. Be prepared to pay only what your research shows is fair for the gold’s weight, purity, and current market value.

Avoid Plated or Gold-Filled Items

These may look like gold but are not suitable for bullion investment.

After your purchase, consider how and where your gold will be stored to ensure it remains secure and in your direct control.

Before buying, clarify your investment goals to make sure your gold purchase aligns with your long-term financial strategy.

Avoiding Scams and Counterfeits at Pawn Shops

When it comes to buying gold at pawn shops, one of the biggest challenges is steering clear of scams and counterfeit items. The gold market is full of opportunity, but it’s also a space where less scrupulous sellers can take advantage of unwary buyers—especially when it comes to physical gold like gold bars, gold coins, or gold jewelry.

To confidently navigate the world of pawn shop gold, start by researching the shop’s reputation. Look for online reviews, check if the pawn shop is licensed, and see what other gold investors have to say about their experiences. A reputable dealer with transparent pricing and a history of fair dealings is far less likely to sell fake or misrepresented gold.

Before you purchase, make sure you’re up to date on current gold prices and the value of the specific gold items you’re interested in. Understanding the gold content and market value of gold investments—whether it’s a gold coin, a piece of jewelry, or a gold bar—will help you spot red flags and avoid overpaying.

Always inspect gold items closely for hallmarks, stamps, or other markings that indicate purity and authenticity. If a pawn shop can provide a certificate of authenticity for gold bars or coins, that’s a strong sign you’re dealing with a legitimate product. Don’t hesitate to ask questions about the gold’s origin, and be wary of sellers who are evasive or pushy.

Be especially cautious if you come across gold being sold at prices far below the regular market value. While everyone loves a bargain, deals that seem too good to be true often are—these could be signs of counterfeits or scams. In such cases, consider alternative options like buying from online dealers or established gold dealers who offer buyer protection, transparent pricing, and a clear return policy.

If you’re new to gold investments, remember that pawn shops are just one way to buy physical gold. For a more cost-effective way to diversify your investment portfolio, you might also explore gold ETFs, mutual funds that invest in gold mining stocks, or even a gold IRA for retirement savings. These options can help you hedge against economic uncertainty and add precious metals to your wealth strategy without the risks of handling physical gold.

Ultimately, whether you’re buying gold jewelry, gold coins, or investing in other precious metals, the key is to stay informed, do your research, and prioritize your financial security. By taking these precautions, you can protect your investments and make smarter decisions in the gold market—whether you’re shopping at a pawn shop or exploring other avenues for gold ownership.

Pawn Shop Bullion Risks: What to Watch Out For

There’s a reason buying from pawn shops is riskier than using certified dealers. There are several potential risks, including authenticity issues, overpricing, and challenges when you want to sell gold later. Here are key pawn shop bullion risks:

Fake or Counterfeit Items

Without documentation or certification, there’s always a risk of fakes — especially with gold bars and coins.

Overpriced Inventory

Some pawn shops price gold well above spot value, preying on inexperienced buyers.

Misrepresented Karat or Weight

A ring marked “18K” might really be 14K — testing is essential.

No Assay Cards or Certificates

You likely won’t get packaging or proof of authenticity, which reduces resale value and can make selling or reselling your gold more difficult.

Limited Return Policies

Most pawn shops offer sales “as-is,” meaning you’re stuck with your purchase. If you later need to sell gold you bought from a pawn shop, you may face additional challenges due to lack of documentation or market trust.

Buy Gold Pawn Shop vs. Reputable Bullion Dealer

| Feature | Pawn Shop Gold | Professional Bullion Dealer |

| Price Negotiation | Often possible | Usually fixed pricing |

| Authenticity Guarantee | Rare | Always provided |

| Return Policy | Limited or none | Typically includes return options |

| Variety & Inventory | Very limited | Extensive & diverse |

| Paperwork/Certification | Usually absent | Provided with each purchase |

Both pawn shops and professional dealers offer precious metal products, but professional dealers generally provide a higher level of assurance and documentation.

Costs can vary significantly between pawn shops and professional dealers, with professional dealers often offering more transparent pricing and lower markups due to reduced overhead and efficient storage and delivery.

While you can occasionally score a deal at a pawn shop, a professional bullion dealer like The Bullion Bank offers peace of mind, certified gold, and transparent pricing. Some products from professional dealers may be tax free or eligible for inclusion in an IRA account, making them attractive for retirement savings. Buying from reputable sources also supports portfolio diversification by adding physical precious metals to your investment mix. Alternatively, some investors choose to have funds invest in gold through mutual funds or ETFs for easier access to gold-related assets.

Expert Tip: Use Pawn Shops as a Supplement, Not a Strategy

If you’re serious about investing in gold, consider using pawn shops as a supplement — not your primary source. Think of them like treasure hunts: you may stumble across a good deal once in a while, but don’t count on them for consistent, high-quality bullion. Before making any gold purchases, seek valuable insights from industry experts to help you make informed decisions and optimize your investment strategy.

For long-term wealth preservation, holding gold for a longer period can be a strategic move. Gold's historical ability to preserve wealth and act as a hedge against economic instability makes it a strong addition to your portfolio. As a tangible asset, gold offers security and intrinsic value compared to other financial assets. During stock market downturns, gold often maintains or increases its value, providing important diversification benefits. Additionally, gold mutual funds offer an alternative way to invest in the gold industry without holding physical bullion.

Instead, turn to trusted sources like The Bullion Bank for:

- Fully verified bullion

- Competitive market-based pricing

- Transparent product details and support

How to Safely Buy Gold at a Pawn Shop

Buying gold from a pawn shop can be a smart move — but only if you know what to look for and how to protect yourself. With the right information, a sharp eye, and a bit of caution, you can spot real value among the clutter.

But when in doubt, skip the uncertainty and buy directly from experts.

Ready to invest safely? Explore certified gold and silver at The Bullion Bank — trusted by buyers nationwide.

FAQ: Buying Gold at Pawn Shops

Q: Is gold from pawn shops real?

A: Sometimes, but not always. Always test and verify before buying. For example, you can use a magnet to check if the item is non-magnetic, or request an acid test to confirm authenticity.

Q: Can you negotiate gold prices at a pawn shop?

A: Yes. Most expect negotiation — it’s part of the business model. Remember, gold has historically served as a currency, so understanding its value can help you negotiate better.

Q: Is it cheaper to buy gold from a pawn shop?

A: It can be, but only if you know how to calculate real value and avoid fakes. Gold has historically served as a currency, which means its value is recognized globally and can fluctuate based on market conditions.

Q: What should I avoid when buying gold at pawn shops?

A: Avoid plated gold, items without weight/karat stamps, and anything the seller won’t let you test. Also, be aware that central banks are major buyers of gold and often seek more gold for their reserves, which can influence market prices.

Q: What are the best ways to store gold?

A: Storing gold securely is crucial. Options include using a safe deposit box at a bank, though this may lack insurance and access during crises. Consider private vaults that offer an insurance policy for added protection. Storing gold in politically stable countries with strong legal frameworks, like Switzerland, is also recommended to safeguard your investment.

Q: Are there alternative ways to invest in gold besides physical gold?

A: Yes, you can invest in exchange traded funds (ETFs) that track the price of gold or gold mining companies. ETFs offer liquidity and diversification without the need to physically store gold.

Q: Who typically buys gold?

A: Buyers range from investors seeking diversification to gold bugs—those passionate about gold as a safe haven asset. Central banks and collectors also frequently purchase gold.

Q: What is the process for buying gold at a pawn shop?

A: The purchasing process involves selecting an item, verifying its authenticity, negotiating the price, and completing the transaction. Make sure to buy from reputable dealers and understand the legal requirements.

Q: How do transactions work at pawn shops when selling gold?

A: Pawn shops usually pay cash for gold on the spot after evaluating and testing your items. They focus on quick, direct transactions and may offer immediate payment for gold, diamonds, and other valuables.