For many couples, gold feels like the ultimate Valentine’s Day gift: it is beautiful, enduring, and carries a sense of “forever” that flowers and chocolates never quite match. The real question is whether a piece of gold jewellery or a more investment‑style bullion coin or bar is the smarter choice for your partner and your long‑term plans.

Why Gold Gifts Feel Different on Valentine’s Day

Gold stands out because it bridges emotion and value: it is both a romantic symbol and a real asset. A well‑chosen gold gift can still look and feel special years from now, long after the holiday is over.

That is why the gold jewellery vs bullion decision matters. You are not just choosing a look; you are choosing how much of your budget goes into design and sentiment versus pure metal content and long‑term value.

Jewelry vs Bullion: What’s the Real Difference?

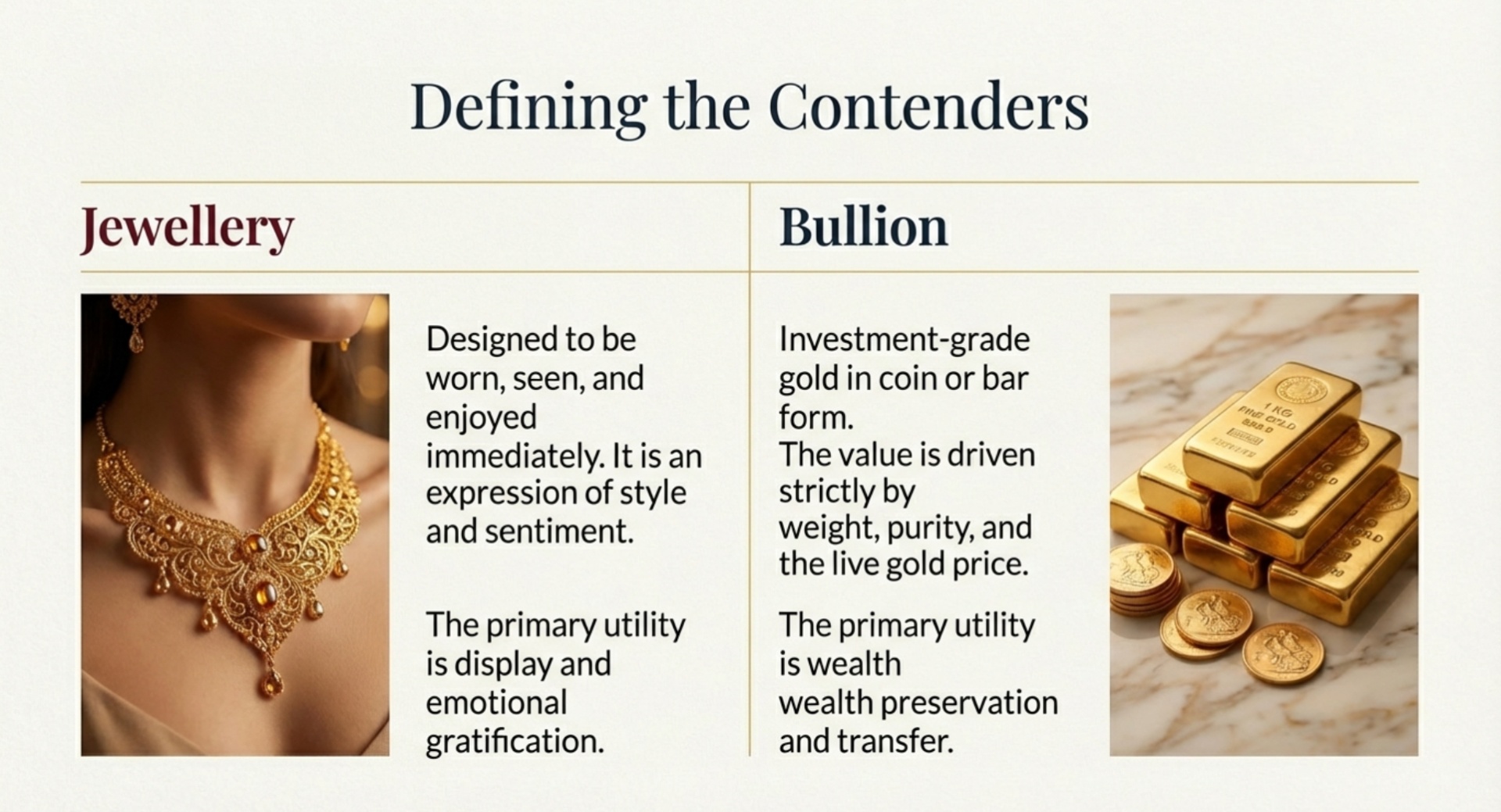

Gold jewellery is designed to be worn and seen, with much of its price tied up in craftsmanship, branding, and style. The gold content matters, but retail markups and fashion trends also play a big role in what you pay and what you could later get back if you ever sell or trade it.

Bullion, by contrast, is investment‑grade gold in coin or bar form, where value is driven mainly by weight, purity, and the live gold price. Bullion coins and bars from a dealer like The Bullion Bank are priced much closer to spot gold, with transparent premiums and a clear resale market.

How Jewelry Holds (and Loses) Value

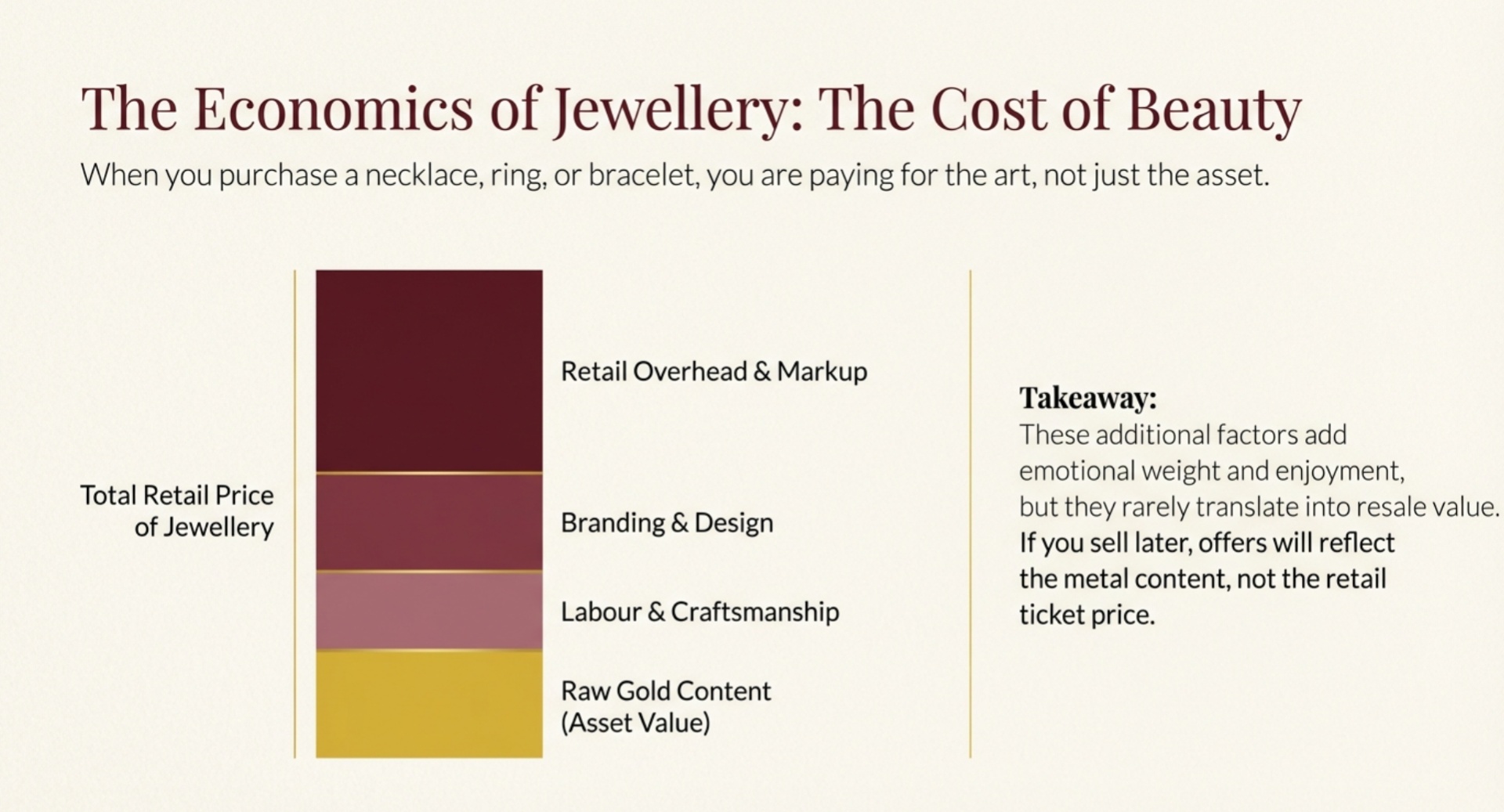

When you buy a gold necklace, ring, or bracelet, you are paying for more than just the metal: you are also paying for design, brand name, labor, and retail overhead. Those factors add enjoyment and emotional weight, but they rarely translate into full resale value.

Over time, classic, high‑karat pieces tend to hold value better than trendy or heavily branded fashion items. Still, when you sell, most buyers will focus on the gold content, not what you originally paid at retail, which is why jewelry often recovers less of its purchase price than bullion does.

How Bullion Coins and Bars Hold Value

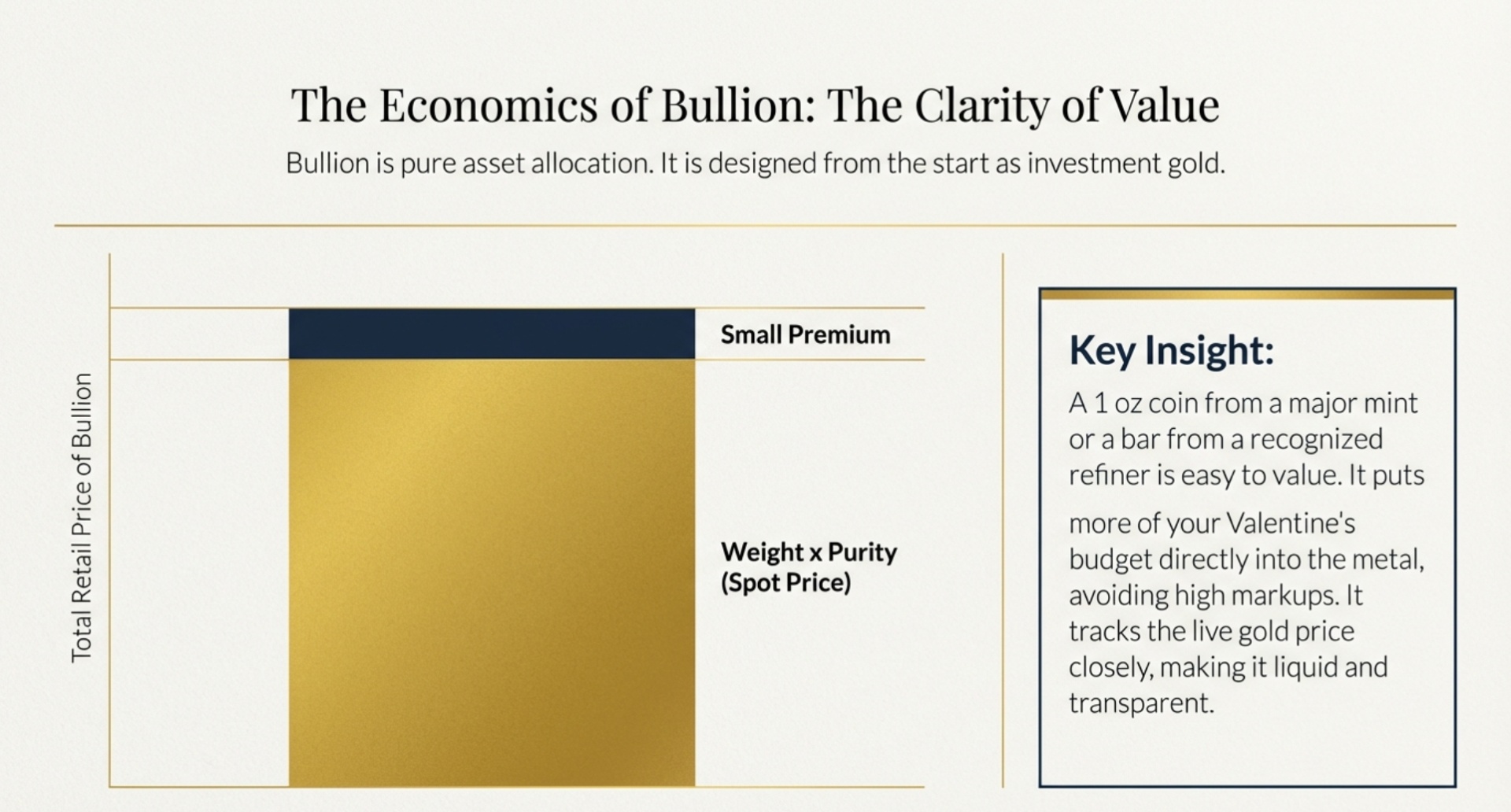

Bullion coins and bars are designed from the start as investment gold. A 1 oz bullion coin from a major mint or a bar from a recognized refiner is easy to value: weight times purity, plus or minus a relatively small premium based on market conditions.

That makes an investment gold gift—such as an American Gold Eagle, Maple Leaf, or a small gold bar—a clear way to put more of your Valentine’s budget into metal rather than markup. It is also easier to track and understand the value of a bullion gift over time because it moves closely with the gold price.

When a Gold Necklace (or Ring) Is the Smarter Valentine’s Gift

If your partner loves jewelry, posts outfit photos, or talks about specific styles they would like to wear, a piece of gold jewellery may be the better Valentine’s gift. The emotional impact of opening a necklace or ring designed just for them is hard to beat, especially on a day that is all about romance.

Jewelry can still be “value smart” if you focus on classic designs, higher‑karat gold, and pieces that suit your partner’s real lifestyle. In this scenario, the jewellery vs bullion debate leans toward jewelry because the main return you are aiming for is emotional, not financial.

When a Gold Coin or Bar Is the Smarter Valentine’s Gift

For some partners, especially those who follow markets, talk about investing, or already like stacking metals, bullion is the smarter Valentine’s Day gold gift. A well‑chosen gold coin or bar functions as a romantic gesture and a long‑term asset you both can treat as part of your shared future.

A Valentine’s gold coin vs necklace decision often tilts toward the coin if your partner gets excited by the idea of watching an investment gold gift grow in value over the years. Pairing the coin or bar with a personal note about your goals together can make it just as romantic as a piece of jewellery, while keeping more of your budget in pure gold.

Valentine’s Gold Coin vs Necklace: Real‑World Scenarios

- If your partner loves styling outfits and jewelry is part of their everyday expression, a necklace, bracelet, or ring is likely to land better than a bar locked away in a safe.

- If your partner reads about finance, collects coins, or has mentioned wanting “real gold” as an investment, a bullion coin or small bar is almost certainly the better fit.

You can also blend the two: for example, choose a modest necklace now and a fractional bullion coin as a “quiet investment” you both keep for the future.

Pros and Cons: Gold Jewellery vs Bullion at a Glance

Gold jewellery – pros:

- High emotional impact and immediate wearability.

- Visible symbol of affection, especially for partners who enjoy fashion and accessories.

Gold jewellery – cons:

- Higher markups mean less of the price is in pure gold.

- Resale value often reflects metal content, not original retail price.

Gold bullion – pros:

- Priced closer to metal value, with clear connection to the gold spot price.

- Easier to track, value, and potentially resell in the future.

Gold bullion – cons:

- Less obviously romantic at first glance if your partner expects traditional jewelry.

- Needs thoughtful presentation (note, box, story) to feel like a Valentine’s gift rather than a generic investment.

For many couples, the smartest move is to choose the format that best matches the partner’s personality and then buy it from a trusted dealer with transparent pricing and a two‑way market, such as The Bullion Bank.

Budget and Practicalities: How Much Should You Spend?

There is no perfect number, but it helps to think about Valentine’s spending in the context of your overall finances and relationship stage. A small, well‑chosen bullion coin can be just as meaningful—and often more financially sound—as an oversized jewellery purchase that strains your budget.

Because The Bullion Bank offers a range of gold coins and bars in different sizes, you can match your investment gold gift to the amount you feel comfortable spending, from fractional pieces up to full‑ounce coins and beyond. The same logic applies to jewelry: size is less important than choosing something that feels genuinely thoughtful.

How The Bullion Bank Can Help You Decide

If you are unsure where to land on gold jewellery vs bullion, talking through your options with specialists can simplify the decision. The Bullion Bank is a leading precious metals dealer in Northern Virginia with physical locations in Chantilly and Vienna, plus a convenient online catalog.

The team can walk you through popular gold coin and bar options for Valentine’s Day, explain current pricing and availability, and help you compare them with the idea of giving or upgrading jewelry. Because they also operate a busy Cash for Gold service, they understand both sides of the equation: what jewellery really brings when sold and how bullion behaves over time.

Turning Old Jewelry into a New Valentine’s Gold Gift

One smart strategy is to turn unused or outdated jewelry into the foundation of an investment gold gift. You can bring older pieces to The Bullion Bank for a fair gold appraisal, receive an offer based on accurate testing, and then choose whether to take cash or use the value toward a bullion purchase.

This lets you declutter, capture the value of gold you are not wearing, and redirect it into a Valentine’s Day gold coin or bar that fits your partner’s taste and your shared financial plans. It is a practical way to combine sentiment, sustainability, and investment thinking in one move.

Simple Steps to Pick the Right Gold Gift This Valentine’s Day

A straightforward approach can help you answer the jewellery vs bullion question confidently:

- Think about your partner first. Do they light up at new jewelry, or talk more about investing and long‑term goals?

- Set a realistic budget. Decide what you can spend comfortably and stick to it, whether you choose a necklace or an investment gold gift.

- Match format to personality. Choose a necklace, ring, or bracelet if they love wearing gold; choose a coin or bar if they like tangible investments.

- Choose recognisable products from a trusted dealer. For bullion, lean toward well‑known coins and bars; for jewelry, prioritize quality and classic style.

- Ask questions before you buy. A reputable shop will explain pricing and options, whether you are browsing jewellery or bullion.

The goal is a Valentine’s gold gift that feels romantic today and still makes sense to both of you in a few years.

FAQ: Jewelry vs Bullion as a Valentine’s Gold Gift

Q: Is gold jewellery or bullion a better Valentine’s Day gift?

A: It depends on your partner. Jewelry wins when they value something they can wear and show off, while bullion is better if they appreciate investing and like the idea of an asset that closely tracks the gold price.

Q: What is the best gold gift for a partner who likes investing?

A: For a financially minded partner, an investment gold gift such as a well‑known bullion coin or small bar usually lands better than another piece of jewelry. It shows you understand their interests and care about your shared long‑term plans.

Q: Are gold coins a good gift, or should I stick to jewelry?

A: Gold coins can be excellent gifts if you present them thoughtfully and your partner likes the idea of owning bullion. If they are not interested in investing or collectibles, a simple, elegant piece of jewelry may feel more immediately special.

Q: Does gold jewellery hold its value as well as bullion?

A: Generally, no. Jewelry carries additional cost for design, labor, and branding, so resale offers often reflect metal content more than retail price. Bullion is easier to value and tends to track the underlying gold price more closely.

Q: What size gold coin or bar makes sense as an investment gold gift?

A: For Valentine’s Day, many buyers choose fractional coins or 1 oz coins and bars, depending on budget. Recognisable pieces from major mints and refiners are usually the best options because they are easy to value and resell.

Q: Can I trade old jewelry for a bullion coin as a Valentine’s gift?

A: Yes. You can bring in old or unwanted jewelry for appraisal, accept a fair cash offer, and then use those funds to buy a bullion coin or bar as a new Valentine’s gold gift. This is a practical way to upgrade from pieces you no longer wear into something that fits your current goals.

Q: Where can I buy gold coins or bars for a Valentine’s Day gift in Northern Virginia?

A: The Bullion Bank serves customers from its locations in Chantilly and Vienna as well as online, offering a wide selection of gold coins and bars, real‑time pricing, and a team that can help you choose the right gift for your partner.

Ready to choose a Valentine’s gold gift that feels romantic today and still makes sense tomorrow? Explore gold coins and bars online or visit The Bullion Bank in Chantilly or Vienna to talk through the best jewelry vs bullion options for your partner before you buy.