This article explains why many investors still favor physical gold and silver over “paper gold” products like ETFs, pooled accounts, and futures. It compares ownership, risk, liquidity, costs, storage, and redemption, using real‑world examples such as GLD and IAU, and offers a practical framework for deciding how much of each type of exposure belongs in a long‑term plan.

Why the choice between physical and paper gold matters

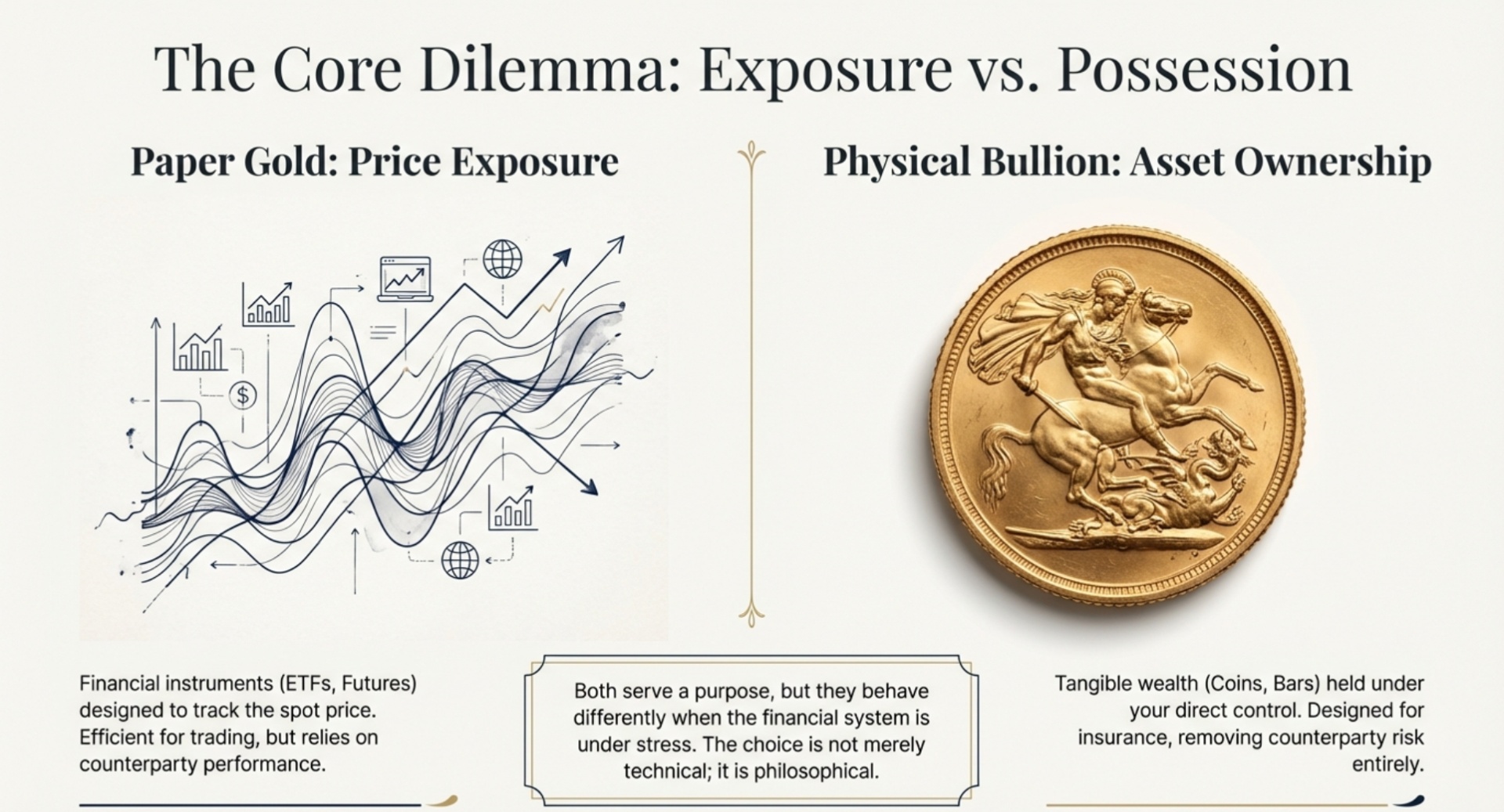

When you compare physical bullion and paper gold, you are deciding whether you want to own gold itself or a financial product that tracks gold’s price. Both can be useful, but they behave very differently in terms of control, counterparty risk, and how you access your wealth in a crisis.

A more traditional cost-and-convenience comparison can be found in independent analyses such as this gold ETFs vs physical gold comparison.

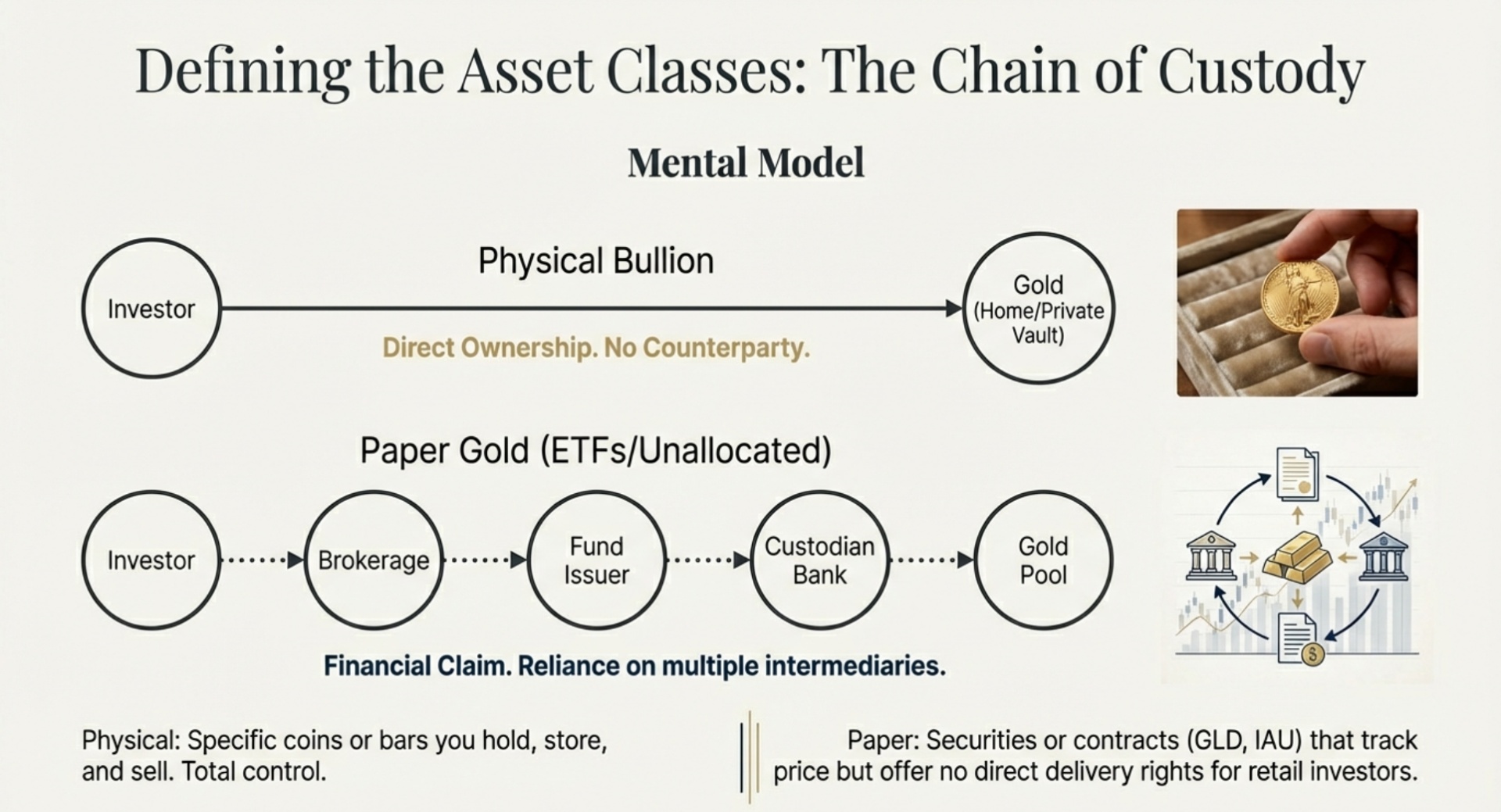

Physical bullion means specific gold or silver coins and bars that you can hold, store, and eventually sell or pass on. Paper gold includes ETFs, mutual funds, pooled or unallocated accounts, and futures or structured notes that provide price exposure without direct delivery rights for typical investors.

Physical vs paper gold comparison

Physical vs Paper Gold Comparison

| Feature | Physical bullion (coins/bars) | Paper gold (ETFs, funds, pooled) |

|---|---|---|

| Ownership | You own specific coins or bars directly. | You own shares or claims on pooled assets, not specific bars. |

| Risk | No product‑level counterparty risk if you control the metal; storage risk is on you. | Multiple counterparties (issuer, custodian, broker); product and operational risks exist. |

| Liquidity | Highly liquid globally via dealers and shops, but not “one‑click.” | Intraday trading in brokerage accounts with tight spreads for major ETFs. |

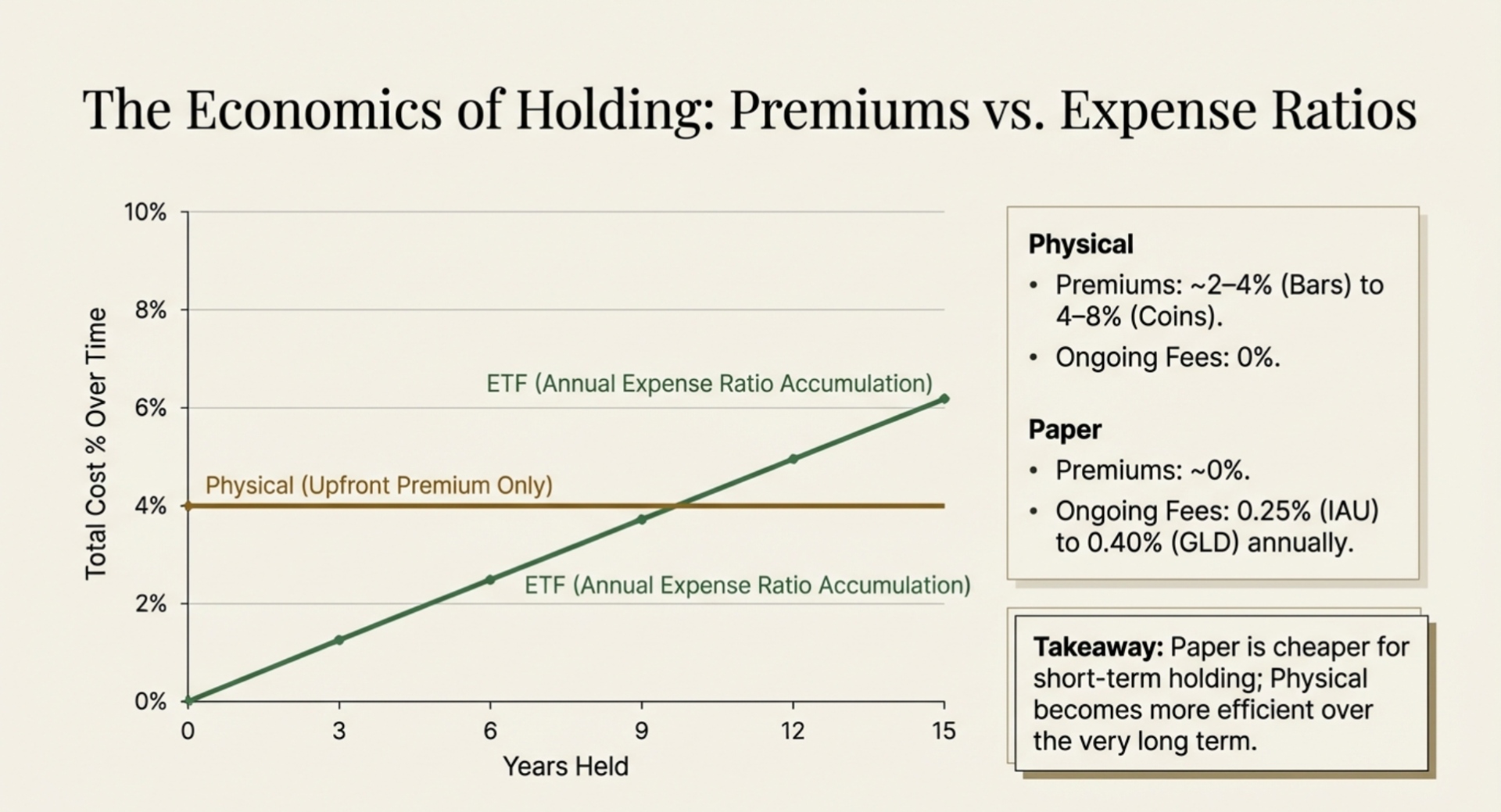

| Costs | Upfront premiums: often ~2–4% over spot for 1 oz gold bars and ~4–8% for sovereign gold coins. | Ongoing expense ratios (e.g., GLD 0.40%, IAU 0.25%) plus trading commissions/spreads. |

| Storage | Requires home safes, bank boxes, or vaults; may incur insurance and storage fees. | Held in custodial vaults arranged by the fund; you do not manage storage directly. |

| Redemption | Sell to dealers or buyers for cash; in some cases, large bars can be swapped. | Retail holders typically cannot redeem for metal; redemptions are limited to large institutions. |

What counts as “paper gold” today?

Paper gold spans several product types:

- Gold ETFs and mutual funds that hold or track bullion, such as SPDR Gold Shares (GLD) and iShares Gold Trust (IAU).

- Unallocated or pooled accounts, where your claim is on a pool of gold, not on numbered bars.

- Futures, options, and structured notes that reference gold prices but are entirely financial contracts.

These vehicles give you exposure to gold’s price but usually do not give retail investors the ability to demand delivery of specific bars.

GLD and IAU as real‑world examples

GLD (SPDR Gold Shares) is the largest and most famous gold ETF.

- It holds allocated gold bars in custodian vaults and aims to track the spot price of gold minus its annual expense ratio, which is about 0.40%.

- Shares trade on stock exchanges; only large “authorized participants” can create or redeem shares in exchange for wholesale bar blocks.

IAU (iShares Gold Trust) is a competing gold ETF that offers similar bullion exposure with a lower fee.

- IAU’s expense ratio is about 0.25%, roughly 0.15 percentage points cheaper than GLD, which can mean thousands of dollars in fee differences over a decade on six‑figure investments.

- Like GLD, IAU is backed by vaulted gold and trades intraday, but small shareholders generally settle in cash, not metal.

Long-term fee impact between GLD and IAU has been discussed in detail in this GLD vs IAU cost comparison analysis.

By contrast, buying a 1 oz gold bar or sovereign coin through a dealer typically involves a premium of roughly 2–4% over spot for bars and 4–8% for coins in normal conditions. Those upfront costs can look higher than a 0.25–0.40% annual ETF fee, but physical buyers accept the trade‑off in exchange for direct, tangible ownership.

Direct ownership vs indirect claims

With physical bullion, you own named coins and bars, not a claim on a pool. If storage is under your control or in properly allocated vaulting, no other party has a competing interest in those ounces.

With paper gold, your asset is a security or contract. You rely on fund issuers, custodians, and brokers to maintain the linkage between your shares and the underlying metal and to keep operations functioning, especially under stress.

Some retirement-focused analyses explore this distinction further in discussions of physical bullion versus ETFs for investors.

Tangibility, privacy, and control

Many investors choose tangible gold and silver because they want assets that exist outside brokerage and banking systems. They value being able to see, weigh, and verify their bullion, and they are less exposed to issues like trading halts, platform outages, or broker failures.

Physical bullion can also offer more privacy than securities in custodial accounts, though that must be balanced with secure storage, insurance where appropriate, and clear record‑keeping for tax and estate purposes. Paper gold products, by design, live entirely inside regulated financial infrastructure and are fully reportable.

Liquidity, convenience, and trading flexibility

ETFs like GLD and IAU are extremely convenient for investors who want fast, precise adjustments. You can trade them during market hours with tight bid‑ask spreads, set stop orders, and integrate them easily into rebalancing rules.

Physical bullion is globally recognized and usually easy to sell, but turning it into cash requires a little more work: contacting a dealer, agreeing on a price, and delivering or shipping the metal. For standard coins and bars, dealers may buy a few percent below spot, and spreads widen in extremely volatile conditions.

If you want to explore liquid, recognizable products designed for long‑term investors, you can review a dedicated gold bullion section that focuses on widely traded bars and coins.

Pros and cons of physical bullion

Physical bullion: pros

- Direct, tangible ownership: You hold real coins or bars that are not someone else’s liability.

- Counterparty‑risk protection: Properly held bullion is insulated from fund failures, broker insolvency, or ETF structural issues.

- Long‑term wealth and legacy: Physical metal can be held across generations, outside of any single financial system or currency.

Physical bullion: cons

- Upfront and transactional costs: Premiums of ~2–4% on 1 oz gold bars and ~4–8% on coins, plus possible shipping and storage.

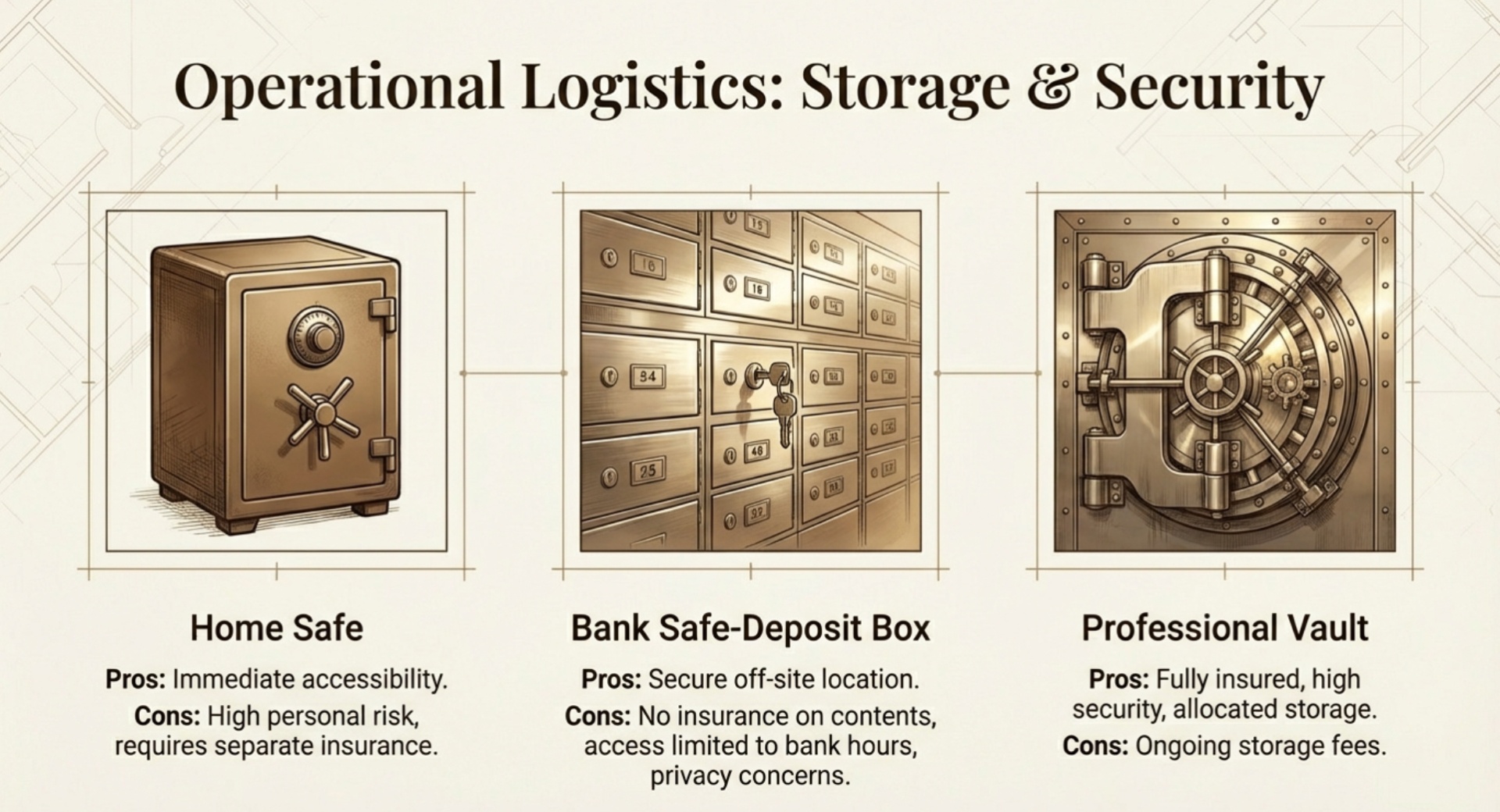

- Storage and security responsibilities: You must arrange a safe, vault, or bank box and possibly insurance.

- Less convenient trading: Selling requires dealing with buyers or dealers, not clicking a button in a brokerage app.

If you are new and want structured guidance, a bullion investment guide that explains safe‑haven gold and silver in detail is a useful starting point.

Pros and cons of paper gold

Paper gold (ETFs, funds): pros

- High liquidity and convenience: Trade like stocks with fine‑grained position sizing and intraday flexibility.

- Lower visible costs: Expense ratios around 0.25–0.40% (IAU vs GLD, for example) can be cheaper than physical premiums for shorter holding periods.

- Easy integration: Fits into existing brokerage accounts and portfolio tools, simplifying rebalancing and tax reporting.

Paper gold: cons

- Counterparty and structural risk: Reliance on issuers, custodians, and market plumbing; retail investors usually cannot demand physical delivery.

- Ongoing fee drag: Even a 0.25–0.40% annual fee compounds into thousands of dollars over long horizons.

- Less psychological and practical “insurance” value: Owning shares in a fund is not the same as having metal you can access independently in a disruption.

Why many investors still prefer physical bullion

For investors focused on long‑term wealth preservation and crisis insurance, physical bullion often sits at the core of their strategy. They want assets that do not depend on any single institution, can be accessed regardless of market conditions, and can be held for decades.

Physical gold and silver also serve as a psychological anchor. Knowing that a portion of your net worth is stored in tangible, globally recognized metal—rather than only in electronic claims—can make it easier to ride out volatility in other parts of your portfolio.

When paper gold is still useful

Even if you favor tangible metal, paper gold can play supporting roles. It can be an efficient tool for:

- Short‑term hedges or tactical trades.

- Incremental adjustments to exposure without moving physical bars or coins.

- Initial “toe‑dip” exposure before committing capital to physical purchases and storage.

Many investors end up with a blended approach: a core in physical bullion, plus a smaller sleeve in ETFs like GLD or IAU for flexibility. A separate article comparing different precious‑metal assets—such as gold vs platinum—can also help frame how physical holdings differ from more financialized exposure.

How to match each type of gold to your goals

The most important step is matching tools to objectives rather than treating them as competing religions.

- If you care most about long‑term wealth insurance, systemic‑risk hedging, and legacy: prioritize physical gold and silver in recognizable coins and bars.

- If you care most about trading flexibility, rebalancing, and small incremental moves: use gold ETFs and other paper products in your brokerage accounts.

How you split between these depends on your risk tolerance, time horizon, and other holdings. Some investors keep metals as a modest slice of their net worth and put the majority of that slice into physical form, with a smaller portion in ETFs for tactical adjustments.

Planning for storage and exit with physical bullion

Committing to tangible metal also means planning for where it lives and how you will convert it back to cash if needed.

Home safes, bank safe‑deposit boxes, and professional vaults all have trade‑offs in cost, access, and privacy. Whatever you choose, clear documentation of your holdings and a thought‑through plan for who can access them if something happens to you are just as important as choosing the right coins or bars.

When it is time to sell, standard bullion can be sold to reputable dealers or local shops, or via established mail‑in programs. To understand the selling process and typical offers in practice, it helps to review specific guidance on getting the best cash‑for‑gold terms from serious buyers.

FAQs about physical bullion and paper gold

What is the difference between physical bullion and paper gold?

Physical bullion is real gold or silver coins and bars you can hold and store yourself. Paper gold is a financial claim—such as an ETF or pooled account—that tracks gold’s price but does not usually give you delivery rights to specific bars.

Is physical gold safer than a gold ETF?

Physical gold removes product‑level counterparty risk because you own the metal directly, though you must manage storage and security. Gold ETFs remain dependent on issuers, custodians, and brokers, which introduces structural and operational risk, especially in extreme market stress.

Why do many investors still buy physical gold and silver in the digital age?

They want tangible assets that are not just entries in a brokerage system and can be accessed regardless of market conditions. Physical gold and silver can serve as long‑term, portable wealth that survives currency changes, inflation, and institutional failures.

Should I own physical bullion, gold ETFs, or both?

Owning both is common. Many investors treat physical bullion as a core, long‑term holding and use gold ETFs for additional, more flexible exposure they can adjust inside a brokerage account.

Is it harder to sell physical gold than a gold ETF?

Selling a gold ETF is usually quicker—you can trade shares during market hours at the click of a button. Selling physical gold requires contacting buyers or dealers, but standard bullion coins and bars are widely recognized and readily saleable in most markets.

How much physical gold should I own compared with paper gold?

There is no universal answer. A common pattern is to keep metals as a modest portion of your portfolio, with most of that in physical bullion and a smaller slice in ETFs, but the exact split should reflect your circumstances and professional advice.

What types of physical bullion are best for long‑term investors?

For long‑term holdings, widely recognized bullion coins and standard bars from reputable mints or refiners are usually best because they are easy to value and resell. Highly collectible or niche items can carry higher premiums and require more expertise, so many newcomers start with simple bullion products.

If you are ready to move beyond pure price exposure and add tangible gold and silver to your plan, start by clarifying your goals, choosing straightforward bullion products, and deciding how physical holdings and ETFs should work together. With a clear framework, you can turn gold from a point of confusion into a deliberate part of your long‑term strategy.