Gold jewelry often has more value than people expect, especially when you add up multiple pieces from an estate, a jewelry box, or old gifts. A rushed decision or a quick sale to the first buyer can easily mean leaving real money on the table.

Taking the time to understand how fair gold appraisal works puts you in control when you sell old gold. It helps you recognize a competitive offer, push back on lowball bids, and feel confident that you are getting a fair deal for your pieces.

How Gold Jewelry Value Is Really Calculated

Every serious buyer uses a version of the same basic formula to value gold jewelry: gold purity, weight, and the current gold price, minus a spread that covers refining and business costs. Knowing these inputs makes it easier to compare offers and see who is treating you fairly.

Reputable buyers tie their offers to live gold prices and explain how they got to the number. At The Bullion Bank, for example, pricing is informed by real‑time precious metals markets and decades of experience in the profession, which translates into accurate, fair pricing for customers.

Karat, Weight, and Spot Price

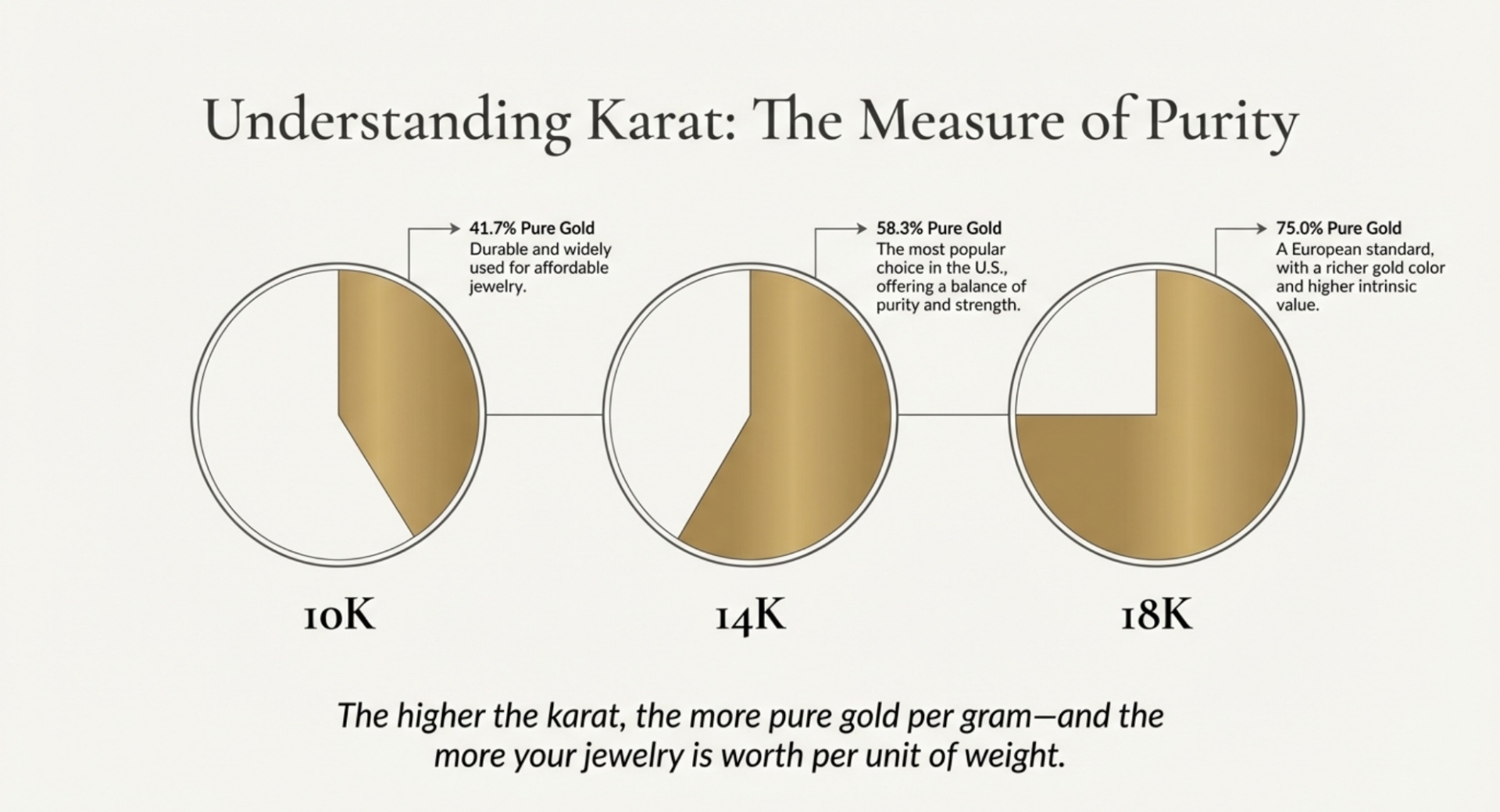

Karat stamps (10K, 14K, 18K, etc.) tell you what percentage of an item is pure gold versus alloy metals. Generally, the higher the karat, the more gold per gram and the more your jewelry is worth per unit of weight.

During appraisal, your buyer will weigh each piece or group of similar pieces and multiply that by the gold content and the current spot price. A fair gold appraisal should give you a clear breakdown of karat, weight, and the market price they used, so you can see how the final offer was calculated.

Why Professional Testing Matters

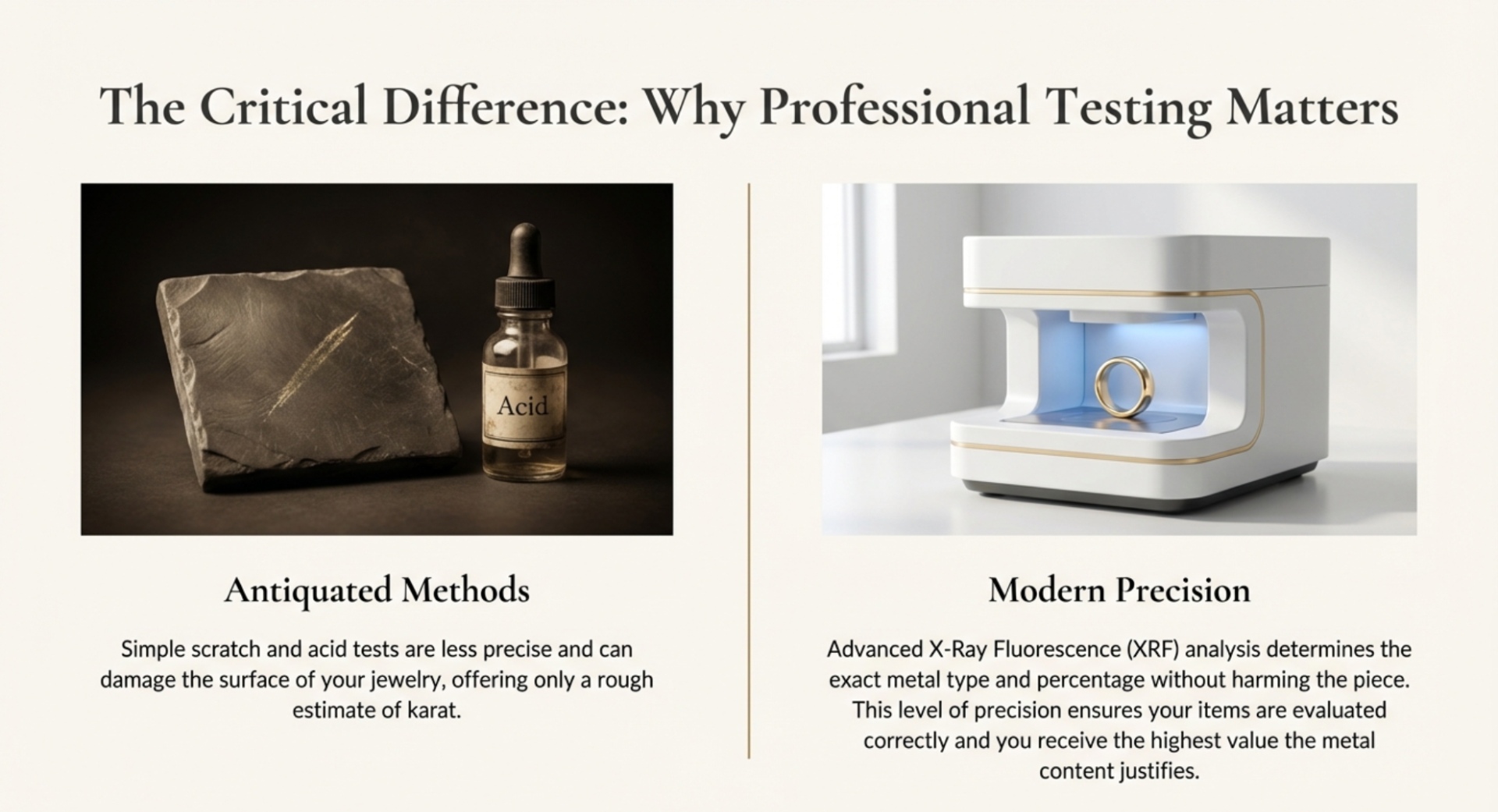

Not all testing methods are equal. Simple scratch and acid tests can be quick, but they are less precise and may damage the jewelry surface. More advanced tools like X‑ray fluorescence (XRF) analysis allow buyers to determine metal type and percentage without harming the piece.

The Bullion Bank utilizes expert assaying services and state‑of‑the‑art X‑ray fluorescence analysis to identify the metal content of items, including gold, silver, platinum, and more. That level of precision helps ensure your gold jewelry is evaluated correctly and that you receive the highest amount of money the metal content justifies when you sell unwanted precious metals.

Common Mistakes That Cost You Money When You Sell Old Gold

A few avoidable mistakes can significantly reduce what you walk away with when you sell gold jewelry for best price:

- Selling to the first buyer without comparison. Taking the very first offer—especially from a temporary kiosk or mail‑in service—makes it hard to know if the price is competitive.

- Not knowing your karat marks or approximate weight. Walking in blind makes it easier for dishonest buyers to undervalue your items.

- Ignoring current gold prices. If you do not know roughly what gold is trading for, it is harder to judge whether an offer seems fair.

- Mailing jewelry to a faceless cash‑for‑gold service. Without in‑person testing and explanation, you have less visibility into how your pieces were appraised and less leverage to challenge a low quote.

Avoiding these pitfalls sets the stage for a stronger negotiating position and a better outcome.

How to Prepare Your Gold Jewelry Before You Sell

Preparing your jewelry properly can make the appraisal smoother and help you get the best price.

- Separate gold from non‑gold items. Remove clearly costume pieces and separate items by karat if you can identify stamps like 10K, 14K, or 18K.

- Untangle and organize. Group similar items together (chains with chains, rings with rings) and make a simple list so you can track what is evaluated and what offer you receive for each group.

- Check recent gold prices. You do not need to track every tick, but knowing the approximate spot price for gold gives context when you hear an offer.

- Consider stones and other components. In some cases, diamonds or gemstones may be valued separately; in other cases, only the metal value is considered. A professional buyer can explain which applies to your pieces.

Turning up prepared signals that you are an informed seller, which often leads to clearer communication and better offers.

What a Fair Gold Appraisal Looks Like

A fair gold appraisal is transparent and easy to follow, even if you are not an expert. You should be able to see your jewelry being weighed and tested, understand the karat assessment, and hear how the buyer connects those results to a specific price per gram or per item.

At The Bullion Bank, the process is built around transparency: expert assayers use advanced testing, staff explain what they are doing and why, and the pricing philosophy is anchored in accurate, fair pricing for customers. Clean, well‑lit, secure shops in Northern Virginia also help sellers feel safe and comfortable during the transaction.

Questions to Ask Any Cash‑for‑Gold Buyer

Asking the right questions helps you quickly gauge whether a buyer is serious and fair:

- How do you test my gold? (Look for mention of professional equipment like XRF or careful assaying.)

- Are your offers based on today’s live gold price?

- What percentage of the gold value do you typically pay?

- Can you walk me through how you calculated this offer?

If a buyer will not answer these questions clearly, rushes you, or discourages you from getting a second opinion, that is a strong signal to walk away.

Why Sellers in Chantilly and Vienna Choose The Bullion Bank

Location and reputation matter when you search for cash for gold Chantilly or cash for gold Vienna. The Bullion Bank is a licensed precious metals dealer in Northern Virginia with physical locations in Chantilly and Vienna serving the wider DC metro area.

The company combines professional assaying, state‑of‑the‑art testing, and a dedicated staff of real people who focus on accurate, fair pricing for gold jewelry, scrap, estate items, diamonds, and high‑end watches. For local sellers, that means you can discuss your situation face to face, see the process, and make an informed decision without mailing your items away.

Cash for Gold in Chantilly

The Bullion Bank’s Chantilly headquarters is located at 4086 Airline Pkwy, right off Route 50, with convenient weekday and Saturday hours. Residents can bring gold jewelry, coins, and other items for on‑the‑spot evaluation, ask questions about how the offer is calculated, and decide whether to take cash or explore other options like bullion.

Because the shop is set up for both retail bullion and refining, the team can handle everything from a single ring to larger estate lots and provide a fair gold appraisal in a secure, professional environment.

Cash for Gold in Vienna

The Vienna location at 131 Maple Ave W offers the same core services for sellers closer to that side of Northern Virginia. Whether you are cleaning out a jewelry box, settling an estate, or simply ready to convert older pieces into something more useful, you can expect the same transparent process and accurate, market‑based pricing.

Selling locally in Vienna also means you keep control of your items until you agree to a price, instead of shipping them to a remote buyer with limited visibility into what happens behind the scenes.

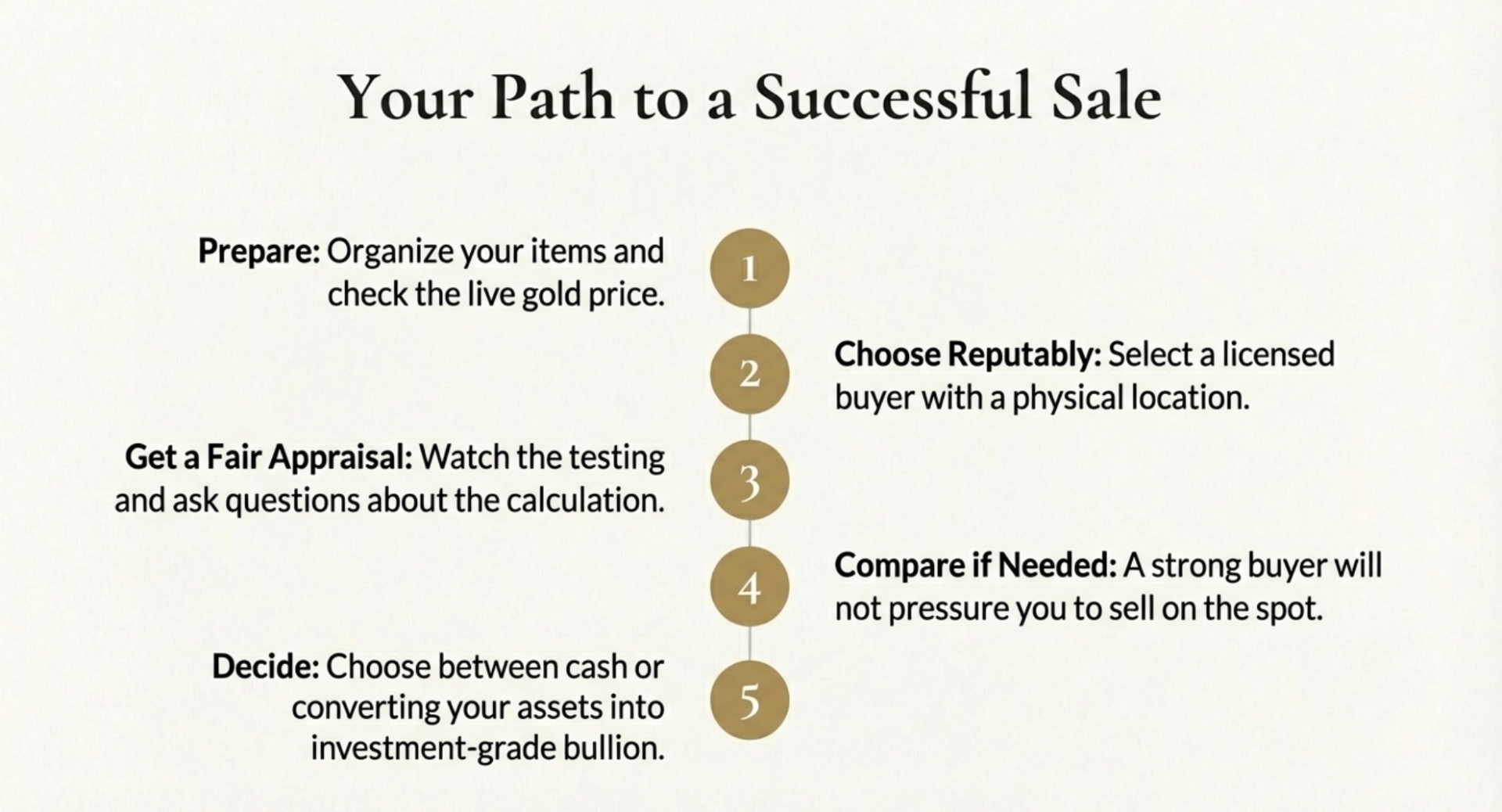

Step‑by‑Step: How to Sell Gold Jewelry for the Best Price

If you want to sell gold jewelry for best price, following a simple, structured process helps:

- Prepare your items. Separate gold from non‑gold pieces, identify karat marks where possible, and make a list of what you plan to sell.

- Check the gold price. Look up the current spot price for gold to have a baseline before you visit any buyer.

- Choose reputable buyers. Focus on licensed, established businesses with physical locations and clear information about their cash‑for‑gold services, like The Bullion Bank.

- Get a fair gold appraisal. Watch the testing and weighing, ask how the offer is calculated, and take notes on what you are told.

- Compare offers if needed. For larger amounts, it can make sense to get a second quote. A strong buyer will not pressure you or object to this.

- Decide between cash and bullion. If you still like gold as a long‑term asset, consider whether converting jewelry into bullion is more aligned with your goals than taking all cash.

This approach gives you the best chance of maximizing your payout while staying comfortable with each step.

When It Makes Sense to Trade Jewelry for Bullion Instead of Cash

Sometimes your goal is not just to get cash for gold but to upgrade from older, worn, or out‑of‑style jewelry into simple investment pieces. In those cases, turning jewelry into bullion can be a smarter way to align your gold with your long‑term plans.

Because The Bullion Bank provides a two‑way market in bullion coins and bars, you can convert unwanted jewelry into either cash or bullion. For example, you might sell several small jewelry items and use part of the proceeds to buy a gold coin or bar, keeping your exposure to gold while simplifying your holdings.

FAQ: Selling Gold Jewelry for the Best Price

Q: How can I get the best price when I sell my gold jewelry?

A: You get the best price by understanding how gold is valued, preparing your items, checking current gold prices, and working with a reputable buyer who explains their testing and pricing. Comparing at least one or two offers for larger amounts can also help maximize your payout.

Q: How do I know if a gold appraisal is fair?

A: A fair gold appraisal is transparent: you see your jewelry being weighed and tested, you are told the karat, and the buyer explains how the offer relates to the current gold price. If the process is vague or rushed, or the buyer cannot answer basic questions, it is a sign the offer may not be fair.

Q: Is it better to sell gold jewelry to a local shop or a mail‑in cash‑for‑gold service?

A: Local shops give you more visibility and control because you stay with your items during testing and can decline the offer on the spot. Mail‑in services may be convenient, but you have less transparency, and it can be harder to negotiate or retrieve your jewelry if you are unhappy with the price.

Q: What should I do before bringing my gold jewelry in to sell?

A: Separate gold items from costume pieces, look for karat marks, untangle chains, and make a list of what you plan to sell. It also helps to check the current gold price so you have context for evaluating offers.

Q: How is the price of my gold jewelry calculated?

A: Buyers calculate price based on the karat (gold purity), total weight, and the current spot price of gold, minus a spread that covers refining and business costs. A good buyer will show you the weight, explain the karat, and tell you what price per gram or per pennyweight they are using.

Q: Where can I get cash for gold in Chantilly or Vienna, VA?

A: You can visit The Bullion Bank locations in Chantilly and Vienna, which are licensed precious metals dealers serving Northern Virginia and the DC metro area. Both locations offer professional cash‑for‑gold services with expert testing and fair, market‑based pricing.

Q: Can I trade my gold jewelry for gold or silver bullion instead of cash?

A: Yes. If you prefer to keep exposure to precious metals, you can sell jewelry and use some or all of the proceeds to buy bullion coins or bars. The Bullion Bank’s two‑way bullion market makes it straightforward to convert old jewelry into more investment‑focused gold or silver products.

Ready to see what your gold jewelry is really worth? Schedule a free gold jewelry appraisal at The Bullion Bank in Chantilly or Vienna, and decide for yourself whether to take cash, convert to bullion, or explore both options side by side.