Buying gold and silver in Northern Virginia does not have to be confusing or risky. This guide walks beginners through how the process works, how to choose a trusted gold and silver dealer in Northern VA, and how to make a first purchase with confidence.

Why Beginners in Northern Virginia Are Turning to Gold and Silver

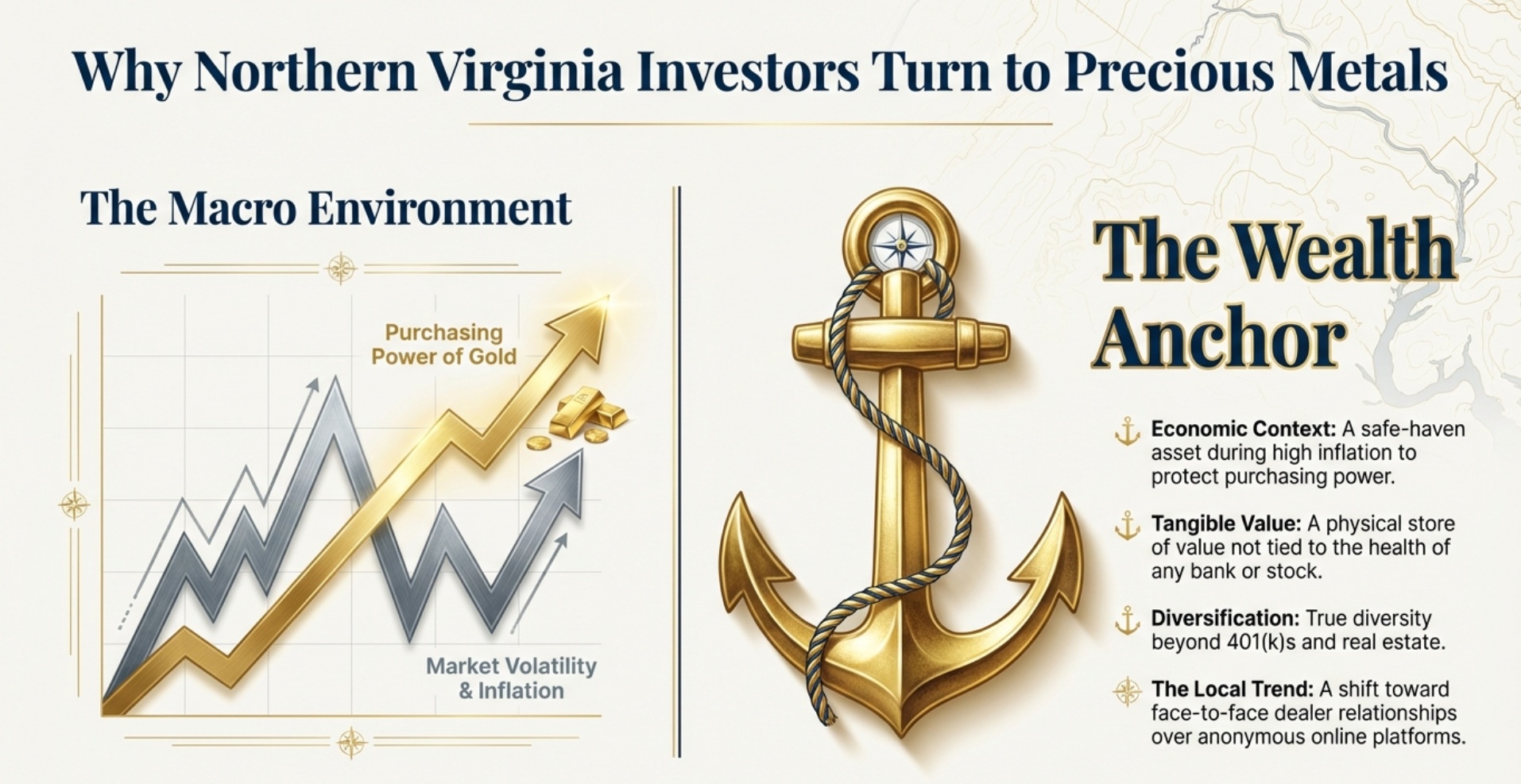

During periods of high inflation and market volatility, many local investors look to physical gold and silver as safe‑haven assets that can help protect purchasing power over the long term. Unlike paper assets, bullion is a tangible store of value and is not tied to the health of any single bank or stock. For beginners in Northern Virginia, gold and silver can be a way to diversify beyond 401(k)s, stocks, and real estate while adding an asset that has held value for centuries.

Gold bullion is often used as a long‑term wealth anchor, while silver bullion offers a more affordable entry point for smaller budgets. As more people in the DC metro area learn about these benefits, interest in buying gold and silver locally has grown, especially among those who want a face‑to‑face relationship with a reputable dealer instead of relying only on anonymous online platforms.

How Buying Gold and Silver Works (In Simple Terms)

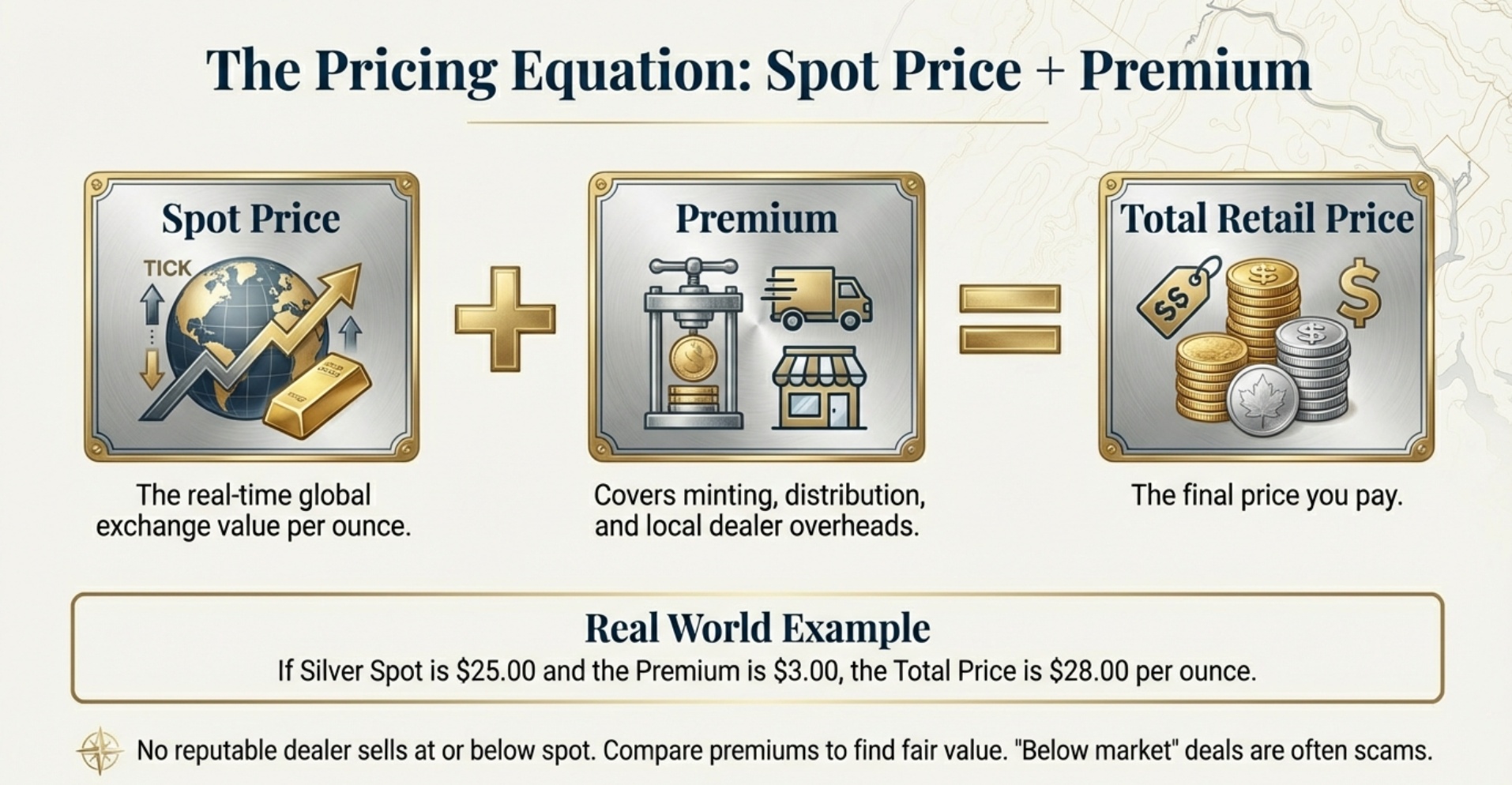

When you buy gold or silver bullion, you are paying more than the raw metal value quoted in financial news or spot price charts. Retail prices reflect both the underlying spot price of gold or silver and an additional amount called a premium, which compensates for minting, distribution, and dealer costs. Understanding these basics helps you compare offers from different gold and silver dealers in Northern VA more intelligently.

Bullion typically comes in two main forms: bars and coins. Bars are straightforward pieces of metal stamped with weight and purity, while bullion coins are legal‑tender or round pieces issued by government mints or private refiners that are valued primarily for their metal content. There are also collectible and “junk silver” coins, but for beginners the focus usually starts with standard bullion products that closely track metal prices.

Gold bullion refers to physical gold in the form of bars, coins, or rounds that are valued primarily for their metal content and purity rather than their rarity or collector appeal. Silver bullion, in the same way, describes physical silver coins, bars, or rounds whose price mainly reflects the underlying silver value plus a modest premium.

In simple terms, when buying gold or silver you pay the live market spot price plus a premium that covers minting, distribution, and dealer costs. Bars and coins are the most common bullion products for beginners because they are easy to understand and compare across dealers.

Spot Price, Premiums, and What You Really Pay

The spot price is the real‑time market price per ounce of gold or silver traded on global exchanges. No reputable Virginia bullion dealer can sell at or below spot for long, so you will always see your final price listed as “spot plus premium,” sometimes described as “X dollars over spot.” For example, if the spot price of silver is 25 dollars per ounce and a local dealer offers a 1 oz silver round at 3 dollars over spot, your total price per coin would be 28 dollars.

For first‑time buyers, the simplest way to think about pricing is spot price plus a premium. Premiums vary depending on the product: highly recognized coins like American Gold Eagles typically cost more over spot than generic bars due to their demand and recognizability. Beginners should learn to compare premiums between dealers rather than focusing solely on headline claims, and they should be wary of offers that appear unrealistically cheap, which can indicate hidden fees or questionable products.

Coins vs Bars: What Makes Sense for Your First Purchase

Gold and silver coins such as American Eagles or Maple Leafs are popular for first‑time buyers because they are widely recognized, easy to resell, and often come in convenient 1 oz sizes. Bars or ingots may carry lower premiums per ounce, especially in larger sizes, making them appealing for buyers with larger budgets who are focused purely on metal content.

For beginners, a practical way to start is with smaller, well‑known coins or 1 oz bars. These products are easier to understand, straightforward to price, and more liquid if you decide to sell them back to a dealer later.

Choosing a Trusted Gold and Silver Dealer in Northern Virginia

Picking the right gold and silver dealer in Northern VA is just as important as picking the right coin or bar. You want a dealer that is licensed, transparent about pricing, and willing to take time to educate beginners rather than pushing the highest‑margin products. A professional environment, clear explanations, and straightforward paperwork are all signs you are working with a reputable local gold shop near you.

Red flags can include vague pricing until the last minute, pressure tactics, or an unwillingness to explain how premiums and spreads work. It is worth comparing at least a couple of local options and reading reviews, especially when dealing with cash‑for‑gold style storefronts that focus primarily on buying rather than advising and selling bullion for long‑term investors.

A trusted gold dealer is, in practice, a licensed, well‑reviewed business that publishes clear pricing, explains premiums and fees, and stands behind the authenticity of every product it sells. For beginners, working with this kind of dealer reduces the risk of overpaying, buying the wrong type of product, or running into problems when it is time to sell.

In simple terms, the right dealer in Northern Virginia will answer your questions patiently, show you how pricing works, and make sure you understand what you are buying before you hand over any money.

Why Work With a Local, Licensed Dealer (Not Just Any “We Buy Gold” Shop)

Local, licensed bullion dealers in Virginia offer several advantages over generic pawn shops and “we buy gold” buyers. They typically specialize in both buying and selling bullion, hold the appropriate state and county licenses, and invest in professional testing equipment and secure facilities. Because their business depends on repeat customers, they are more likely to offer fair, market‑based pricing and a transparent process.

By contrast, some gold buyers focus only on paying the lowest possible price to sellers and may have less expertise in advising beginners on what to purchase. For new buyers who want to understand spot prices, premiums, and resale options, a dedicated Virginia bullion dealer is usually a better match than a generic gold‑buying kiosk.

What Sets The Bullion Bank Apart for Beginners

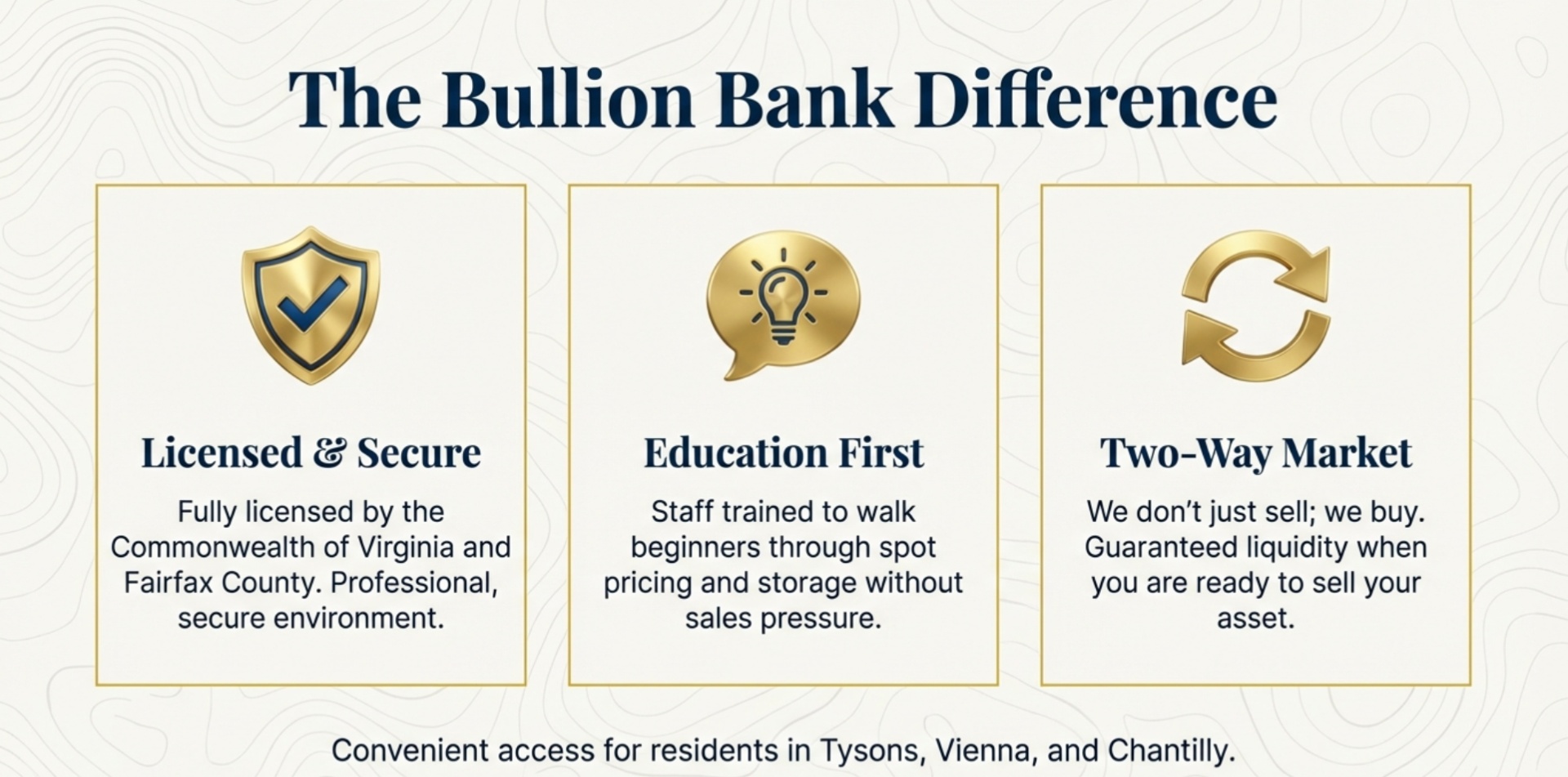

In Northern Virginia, one example of a full‑service precious metals dealer is The Bullion Bank, with two physical locations in Chantilly and Vienna that serve the broader DC metro area. The business is licensed by the Commonwealth of Virginia and Fairfax County and has been operating in precious metals for many years, which can help first‑time buyers feel more secure. Staff specialize in both bullion and buying jewelry, watches, and scrap gold, so they can explain options on both the buying and selling side.

For beginners, having a local gold and silver dealer in Northern VA that is comfortable walking through basics—such as spot pricing, product choices, and storage options—makes the experience far less intimidating. The ability to follow up in person with questions after your first purchase is another key advantage of working with a local shop instead of a purely online platform.

Best Way for Beginners to Buy Gold Locally

For most beginners, the best way to buy gold locally is to combine online research with an in‑person visit to a trusted, licensed bullion dealer in Northern Virginia.

For first‑time buyers, the key takeaway is to start small, choose simple bullion products like 1 oz coins or bars, and work with a reputable local dealer who clearly explains pricing and buy‑back options.

- Compare prices from 2–3 local dealers, focusing on premiums over spot.

- Stick to widely recognized bullion coins and standard‑size bars for your first purchase.

- Meet your dealer in person to ask questions and see how the process works.

- Confirm payment methods, ID requirements, and resale options before you buy.

Step‑by‑Step: Your First Gold or Silver Purchase in Northern Virginia

Even if you have never walked into a bullion shop before, the process can be straightforward when broken into clear steps. This section outlines a practical path you can follow with any trusted Virginia bullion dealer, including long‑standing local shops in Chantilly and Vienna.

Step 1 – Decide Your Budget and Metal Type

- Decide how much you can comfortably invest without touching emergency savings.

- Choose whether you want more compact value (gold) or more pieces for the same money (silver).

- Start with a small, test purchase instead of committing a large lump sum right away.

The main idea for beginners is to buy an amount that feels comfortable, not stressful, and to view the first purchase as a learning experience as much as an investment.

Step 2 – Browse Trusted Products Online

Before visiting a shop, spend time browsing bullion products on a reputable dealer’s website. Many established dealers publish educational content on gold and silver bullion and showcase the types of coins and bars that are commonly available to investors. This gives you a sense of standard weights (such as 1 oz, 10 oz, and fractional coins), common brands, and indicative pricing tied to real‑time markets.

For beginners, a good approach is to use these online guides to create a short list of specific products—like a 1 oz gold coin or a 10 oz silver bar—that you want to discuss in person.

Step 3 – Visit a Local Shop in Chantilly or Vienna

Once you are familiar with basic products, visiting a local gold shop near you transforms the process from abstract research into a real, tangible experience. In professional Northern Virginia bullion shops, staff can show you sample coins and bars, explain differences, and answer beginner questions in plain language. Being able to see and hold physical gold and silver helps new buyers understand weight, size, and quality in a way that photos alone cannot.

For first‑time buyers, this in‑person visit is often where everything “clicks”: you see the products, hear how pricing works, and can gauge whether the dealer feels transparent and trustworthy. If you also have gold jewelry or old coins you are considering selling, this is a good time to ask how their cash‑for‑gold process works and what percentage of metal value they typically pay.

Step 4 – Understand the Quote and Complete Your Purchase

When you are ready to buy, the dealer will provide a quote that reflects current spot prices plus the chosen product’s premium. They should clearly explain how the total is calculated and answer any questions before you pay. Payment options may include cash, certified checks, bank wires, or other methods depending on the purchase amount and store policies.

In simple terms, you want to walk away knowing exactly what you bought, how the price was calculated, and how you could sell the metal back in the future. Before leaving, confirm the details on your receipt and ask about any suggestions for secure storage, such as home safes, safe deposit boxes, or professional vault services.

If you would like personal guidance on your first purchase, you can visit a reputable bullion shop in Chantilly or Vienna to sit down with a specialist and review options that fit your budget and comfort level.

Common Beginner Mistakes to Avoid

Avoiding a few common pitfalls can save new buyers in Northern Virginia significant money and stress. Many mistakes stem from rushing into a purchase without understanding how premiums, liquidity, and dealer reputation affect long‑term value.

Common mistakes include:

- Paying very high premiums for collectible or “proof” coins instead of simple bullion.

- Choosing the cheapest‑looking offer without checking the dealer’s reputation.

- Buying from unverified online sellers or private ads with no clear return policy.

- Ignoring buy‑back policies and spreads, which directly affect your resale value.

Overpaying on Premiums and Fees

One of the most frequent errors is overpaying for products that carry very high premiums relative to their metal content. This can happen when inexperienced buyers are steered toward collectible coins, limited‑edition pieces, or proof finishes that are much more expensive than standard bullion. While there is nothing inherently wrong with these products, they may not be ideal for someone whose primary goal is exposure to gold or silver as an asset.

To protect yourself, compare pricing between several gold and silver dealers in Northern VA and ask how much over spot you are paying for a given coin or bar. If a dealer is reluctant to explain premiums or seems to rely heavily on urgency and fear, that is a sign to slow down and revisit your options.

Ignoring Resale and Liquidity

Another mistake is focusing only on the purchase and not thinking ahead to how easily you could sell the metal later. Highly recognizable bullion coins and standard‑sized bars are typically easier to sell back to dealers than obscure or heavily marked‑up pieces. Products with very high premiums may also be harder to recoup at resale because buyers often pay closer to the metal value.

The key takeaway for beginners is to choose products that are easy to understand, widely recognized, and supported by clear buy‑back policies from the dealer. Asking about resale before you buy helps ensure your first gold or silver purchase remains flexible if your plans change.

Where to Buy Gold and Silver in Northern Virginia

If you are ready to take the next step from research to action, working with a trusted local gold and silver dealer in Northern VA is often the safest and most comfortable path for beginners. Licensed dealers with established reputations have every incentive to provide transparent pricing, answer questions thoroughly, and support long‑term relationships rather than quick, one‑time transactions.

Northern Virginia investors can look for reputable dealers in areas like Chantilly, Vienna, and the broader DC metro, comparing reviews, licensing status, and educational resources before deciding where to buy. Whether you are starting with a single small gold coin, a few ounces of silver, or exploring how bullion fits into your overall financial picture, having a nearby shop where you can talk to real people makes the process far less intimidating.

Why Choose The Bullion Bank

Once you understand the basics, you still need a dealer you can trust with your first purchase. That is where The Bullion Bank can help beginners in Northern Virginia.

For first‑time buyers, The Bullion Bank stands out as a long‑standing, licensed precious metals dealer with two convenient locations in Chantilly and Vienna and a strong focus on fair pricing and education.

- Established dealer serving Northern Virginia and the broader DC metro area since 2008.

- Specializes in gold and silver bullion coins and bars, not just generic “cash‑for‑gold” buying.

- Licensed in Virginia and Fairfax County, with professional testing and secure facilities.

- Offers friendly, in‑person guidance so beginners can ask questions and move at their own pace.

Local Dealer Spotlight: The Bullion Bank in Chantilly and Vienna

If you prefer to work with a nearby shop instead of an anonymous website, The Bullion Bank provides a true local option in Northern Virginia.

- Chantilly location: convenient for many Northern Virginia communities, with on‑site buying and selling of bullion, coins, and jewelry.

- Vienna location: ideal for residents closer to Tysons, Vienna, and surrounding areas looking for a “local gold shop near me.”

- Both locations focus on clear communication, transparent pricing, and a respectful, no‑pressure environment for first‑time buyers.

For beginners, this means you can research online, then step into a physical location where your questions are welcomed and your first purchase can be made face to face. To plan your visit or ask specific questions in advance, you can contact the team and confirm store hours, directions, and any current product availability.

Frequently Asked Questions

How much money do I need to start buying gold or silver in Northern Virginia?

You do not need a huge budget to begin buying bullion; many beginners start with a few ounces of silver or a small gold coin and build gradually over time. The key is choosing reputable, standard products and working with a trusted Virginia bullion dealer who is transparent about premiums and fees.

Is it better to start with gold or silver as a beginner?

There is no single right answer, but gold offers a higher value in a compact form, while silver provides a more affordable way to buy multiple pieces. Many first‑time buyers mix both metals so they can experience the benefits of each and adjust as they learn more.

What is the safest way to buy gold locally in Virginia?

The safest approach is to use a licensed, well‑reviewed gold and silver dealer in Northern VA that clearly explains pricing, shows you products in person, and provides a proper receipt. Avoid high‑pressure sales, unclear fees, or unverified sellers met through private ads and social media.

How do I know if a gold dealer in Northern Virginia is trustworthy?

Look for state and local licensing, professional affiliations, strong customer reviews, and clear explanations of how they price and authenticate products. A trustworthy dealer is happy to answer beginner questions, discuss buy‑back policies, and talk about both buying and selling.

What documents or ID do I need to buy gold in person?

In many cases, small purchases may not require more than standard payment, but larger transactions can trigger ID requirements or reporting thresholds depending on regulations and store policy. Your dealer can tell you exactly what is needed based on purchase size and payment method.

Can I buy gold online and pick it up at a local shop in Northern Virginia?

Some dealers allow you to place orders online and then finalize or pick up the purchase in person, combining convenience with local service. This approach can be especially attractive if you want to lock in a price but still prefer an in‑person handoff.

What is the difference between gold bullion and collectible coins?

Gold bullion generally refers to coins and bars valued primarily for their metal content and traded close to spot price plus a modest premium. Collectible or numismatic coins, by contrast, derive much of their value from rarity, age, or condition and can carry significantly higher premiums that are not ideal for every beginner.

Ready to move from research to action? Schedule a visit or reach out to The Bullion Bank to discuss your goals, compare product options, and plan a first gold or silver purchase that feels right for you.

If you are ready to turn what you have learned into a real plan, your next step is simple: visit a trusted gold and silver dealer in Northern Virginia. The Bullion Bank’s Chantilly and Vienna locations are ready to answer your questions, walk you through current pricing, and help you make your first gold or silver purchase with confidence.