Gold bars and gold coins both give you exposure to physical gold, but they fit slightly different strategies, budgets, and exit plans. Many investors want to know which is the better investment—gold bars or coins—by comparing factors like cost, purity, and how each fits their investment goals. Understanding how they differ on premiums, liquidity, flexibility, and collectability makes it much easier to decide which is the best gold to buy for your own plan, and how each option can support different stages of your investment journey.

Why the “Gold Bars vs Gold Coins” Question Matters

When you first decide to buy physical gold, choosing between gold bars vs coins can feel like a small detail, but it has real consequences for how easily you can buy, store, and eventually sell your metal. The format you pick affects your cost per ounce, how flexible your holdings are, and how comfortable you feel when it is time to trade. Choosing both gold bars and coins can help diversify your portfolio and manage risk, as each format offers different advantages in terms of liquidity and flexibility.

There is no universal “best gold to buy.” Instead, the right choice is the one that matches your goals, time horizon, and how you expect to use gold in your broader financial life.

Quick Overview – Gold Bars vs Gold Coins

At a high level, gold bars are the most straightforward way to stack ounces efficiently, while gold coins are designed to be highly recognizable and easy to trade. Bars tend to appeal to buyers focused on cost per ounce, whereas coins often appeal to those who value liquidity and brand recognition from major mints.

Investors with larger budgets often choose gold bars because they offer the lowest price per gram, thanks to lower premiums. Shopping around for the best deal from different dealers can further optimize your investment value.

Many investors end up with a mix of both: bars for efficient accumulation and coins for flexibility and easier resale. Thinking in terms of “strategy fit” rather than “winner vs loser” usually leads to better long‑term decisions.

What Are Gold Bars?

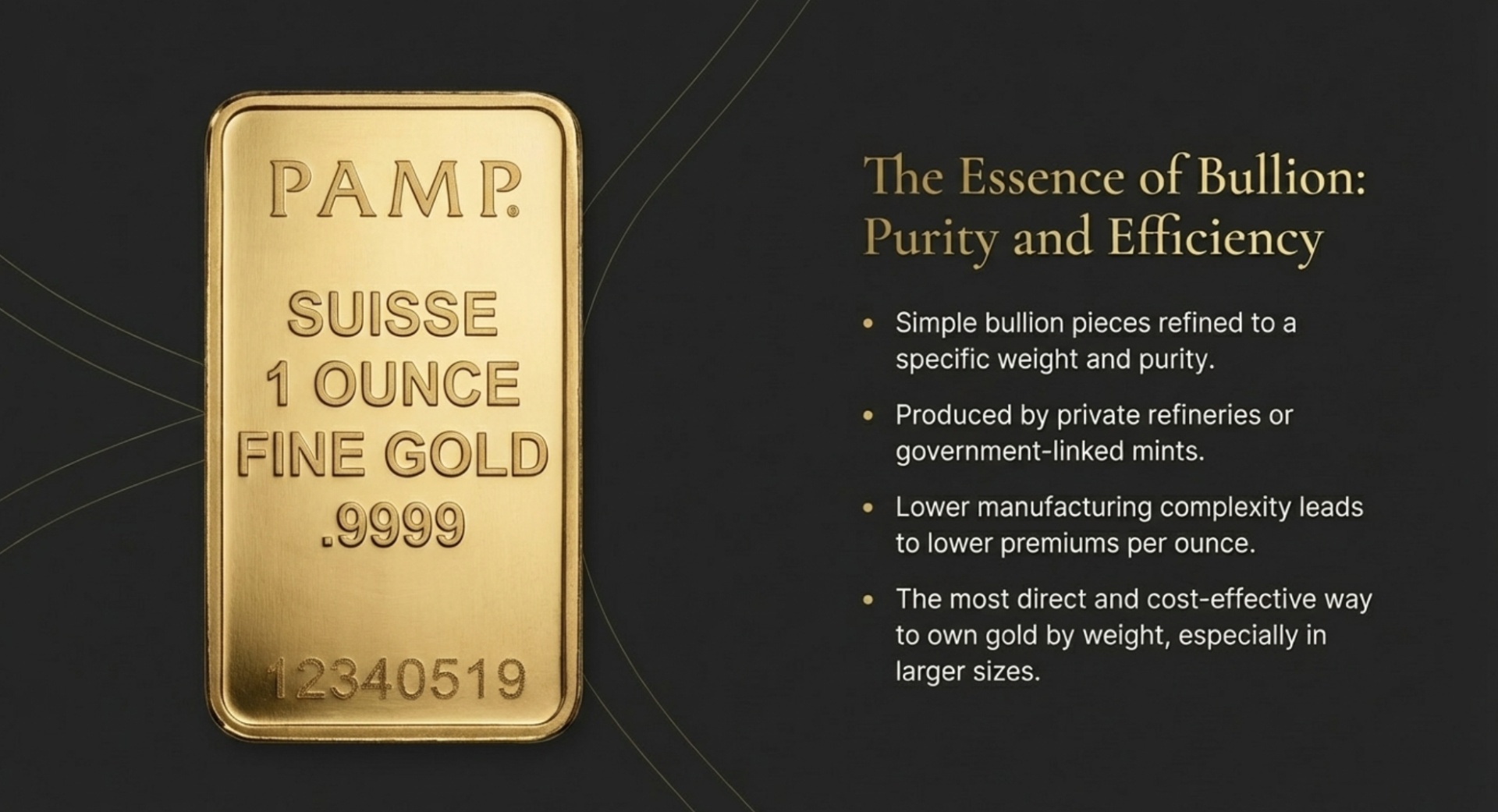

Gold bars are simple bullion pieces refined to a specific weight and purity, typically produced by well‑known private refineries or government‑linked mints. They range from small fractional sizes up through 1 oz, 10 oz, and larger bars, which can make it easier to buy more metal per transaction when you are focused on total ounces rather than design.

Because bars are less complex to produce and often carry less branding than coins, they usually come with lower premiums per ounce at larger sizes. This makes them attractive to buyers who want the most metal for their money and are comfortable thinking in bigger units.

What Are Gold Coins?

Gold coins for investment are typically government‑minted pieces such as American Gold Eagles, American Gold Buffalos, Canadian Maple Leafs, and other bullion coins whose primary value comes from their gold content. These coins are produced to precise weight and purity standards and backed by the issuing country, which makes them widely recognized around the world. Gold coins are produced by leading government mints specifically for investment purposes and are universally recognized, allowing them to be sold instantly without additional verification.

Investment gold coins differ from highly collectible numismatic coins, which carry extra value for rarity, age, and condition. Gold coins are often easier to store due to their standard sizes, but their value is significantly tied to their condition. Many collectible gold coins also have a rich history, with designs that commemorate important events or figures, adding to their appeal beyond just gold content. For most investors searching “gold coins for investment,” the focus is on modern bullion coins where pricing mainly tracks the gold price, with a relatively modest premium for minting and distribution.

Cost and Premiums: Where Each Shines

One of the biggest differences in the gold bars vs coins discussion is premiums—the amount you pay above the spot price of gold. Larger bars generally offer lower premiums per ounce than coins, especially from reputable bullion brands, because they are cheaper to manufacture per unit of gold. Gold coins usually command higher prices and premiums than gold bars due to their rarity, condition, and popularity.

Coins usually carry higher premiums, reflecting their legal‑tender status, detailed designs, marketing, and broad demand from both investors and light collectors. Full and half gold sovereign coins remain popular options due to their size, gold content, and market liquidity. Gold bars are regarded as one of the most cost-effective ways to invest in gold for larger budgets. If your priority is strictly minimizing cost per ounce on larger purchases, bars often have the edge; if you are making smaller, periodic purchases and value recognizability, coins can still make sense even with slightly higher premiums.

Tax Implications and Investment Costs

When investing in physical gold, understanding the tax implications and overall investment costs is crucial to maximizing your returns and protecting your wealth. Gold coins and gold bars are treated differently in various countries, and these differences can have a significant impact on your investment strategy.

In the UK, for example, certain gold coins that are classified as legal tender—such as the Britannia and Sovereign—are exempt from Capital Gains Tax (CGT). This exemption makes these gold coins especially attractive for investors who want to minimize their tax liability when they eventually sell. Gold bars, on the other hand, do not qualify for this exemption and are subject to CGT, which is an important consideration for those planning long term investments in physical gold.

For investors in the US, both gold coins and gold bars are generally considered collectibles by the IRS. This means that any profits from selling your gold holdings are subject to a 28% capital gains tax rate, regardless of whether you’re selling coins or bars. While this rate is higher than the standard long-term capital gains tax, it only applies to the gains you realize when you sell, so it’s important to factor this into your investment planning and timing.

Investment costs are another key factor to consider. Gold coins typically carry higher premiums than gold bars due to their numismatic value, legal tender status, and the additional costs of minting and distribution. These higher premiums can be justified by the coins’ greater liquidity—gold coins are generally more liquid and easier to sell, often attracting a wider pool of buyers, especially for popular bullion coins like the South African Krugerrand or American Gold Eagle. Gold bars, by contrast, usually offer lower premiums and a higher gold content per dollar spent, making them a cost-effective way to accumulate more ounces of pure gold, especially for those focused on long term investments.

To get the best value, it’s wise to compare prices and premiums from reputable dealers such as JM Bullion, which offers a wide selection of gold coins and gold bars at competitive rates. Always verify the authenticity and purity of your gold before completing a purchase—look for clear markings, certificates, and, if possible, buy from dealers who offer performance security and a strong track record. This helps protect your investment from counterfeits and ensures you’re getting the full value of your gold content.

Staying informed about the spot price of gold is also essential, as it directly affects the value of both gold coins and gold bars. Online resources like APMEX and GoldSilver.com provide real-time updates on gold prices, helping you make timely decisions about when to buy or sell. Remember, the spot price is the baseline for all gold transactions, and understanding how premiums and market demand affect final prices will help you make smarter investment choices.

Finally, consider the security and storage of your gold. Whether you prefer the liquidity and numismatic value of gold coins or the low premiums and high gold content of gold bars, protecting your tangible assets is key. Use a secure safe or a professional storage facility to safeguard your holdings, and always keep documentation to verify authenticity and ownership.

By carefully weighing the tax implications, investment costs, and security considerations, you can choose the gold format that best aligns with your investment goals. Whether you’re interested in the flexibility and liquidity of gold coins or the cost efficiency of buying gold bars, understanding these factors will help you create a gold portfolio that supports your long-term financial strategy.

Liquidity and Ease of Selling

Gold coins are widely accepted and easy to resell across global markets due to their universal recognition and smaller denominations, making them highly liquid. Liquidity is where gold coins often shine. Because major bullion coins are widely recognized and come in convenient sizes, they tend to be among the easiest forms of physical gold to sell quickly to dealers and other investors. Gold coins are highly liquid and can be easily resold due to their universal recognition and smaller denominations. A dealer like The Bullion Bank, which makes active markets in both gold coins and gold bars, can typically quote buy prices on common coin series immediately. Collectible gold coins also tend to attract more sellers due to their higher premiums and historical value.

Gold bars are also liquid, especially when they come from established brands with clear markings and serial numbers. However, gold bars require accurate weighing and authenticity confirmation for resale, making them generally less liquid than coins. Investors are more likely to hold onto gold bars for extended periods, reducing their liquidity compared to coins. Less familiar bars, very large bars, or products with limited brand recognition may take a bit more explanation or inspection during resale, particularly if you are selling to multiple potential buyers rather than one trusted dealer. Sellers of gold bars may also face challenges related to storage and authenticity.

1 oz Gold Bar vs 1 oz Gold Coin

For many investors, the specific question is “1 oz gold bar vs coin—which is better?” A 1 oz gold bar usually carries a slightly lower premium than a 1 oz bullion coin from a top mint, giving you a small edge in cost per ounce. That makes the 1 oz bar appealing if you are primarily concerned with efficiency and plan to work closely with a dealer who knows bar brands well.

A 1 oz gold coin, on the other hand, often wins on recognizability and comfort. When you walk into a local shop or contact a dealer like The Bullion Bank, American Gold Eagles or Maple Leafs are instantly familiar, which can make selling feel more straightforward if you are new to precious metals. For many beginners, that reassurance is worth a modest difference in premium.

Flexibility, Storage, and Practical Considerations

If you plan to store gold in a home safe, bank box, or professional facility, both bars and coins can work well, but they fit slightly different preferences. Bars are more compact and stack neatly, especially in uniform sizes, which appeals to buyers building larger positions. Coins, especially in tubes or mint packaging, are also easy to store but take up a bit more volume per ounce due to their shape and protective holders.

Flexibility matters when you need to sell. Having several smaller coins or bars lets you raise a specific amount of cash without touching your entire gold position. This is one reason many investors who buy larger bars also keep some smaller coins or fractional pieces on hand to give themselves options.

Bullion vs Numismatic: Staying Focused on Your Goal

The term “bullion vs numismatic” can confuse new buyers. Bullion gold—whether in bar or coin form—is valued primarily for its metal content; its price tracks the gold spot price plus a relatively transparent premium. Numismatic coins, by contrast, carry additional value for rarity, age, and collector interest, which can make pricing more complex and less tied to spot. Collectible gold coins can also offer investment potential beyond their metal content, with value appreciation driven by factors such as rarity, demand, and historical significance.

If your main goal is long‑term wealth preservation, inflation hedging, or diversification, bullion is usually the starting point. Numismatic coins may appeal later if you develop a specific collecting interest and are comfortable with the additional market dynamics they involve.

Which Is Better for Different Strategies?

There are several common strategies where gold bars vs coins play distinct roles:

- If you are building a long‑term inflation hedge or savings anchor, gold coins from major mints can provide a mix of recognizability, liquidity, and straightforward resale.

- If you are investing larger sums and want to maximize ounces, especially in a tax‑advantaged or professionally stored context, larger gold bars can reduce your average cost per ounce.

- If flexibility is your priority—being able to sell in portions, gift coins, or travel with small units—bullion coins and smaller bars tend to fit better than very large bars.

In practice, many investors choose a blend: bars as the foundation for cost efficiency and coins as the more flexible, easy‑to‑sell layer on top.

How to Decide: A Simple Checklist

A simple way to choose the best gold to buy for your strategy is to walk through a quick checklist:

- Budget and purchase style: Are you making a single large purchase or building your position gradually with smaller, regular buys?

- Need for flexibility: Do you expect to sell in smaller chunks or all at once?

- Comfort with resale: Would you feel more at ease selling widely recognized coins, or are you comfortable working directly with a dealer on bars?

- Storage plans: Where will you store your gold, and does compactness or organization matter to you?

If you are still unsure after answering these questions, a short conversation with an experienced dealer can make the trade‑offs much clearer and help you avoid overpaying for the wrong type of product.

Buying Gold Bars and Coins with The Bullion Bank

When you are ready to move from research to action, working with a trusted dealer that offers both bars and coins side by side makes comparison easier. The Bullion Bank maintains a two‑way market in gold coins and gold bars, with prices updated by the minute and the ability to buy and sell a wide range of bullion products.

With fully insured shipping and physical locations in Vienna and Chantilly, VA, you can choose to shop online or speak to specialists in person about which mix of bars and coins fits your plan best. That combination of online convenience and local expertise is especially helpful if you are making your first significant gold purchase.

The Bullion Bank ensures a secure connection for all online transactions, requires users to verify they are human before proceeding with purchases, and performs a review of security measures to protect customer accounts.

FAQ: Gold Bars vs Gold Coins

Q: Is it better to buy gold bars or gold coins for investment?

A: Neither format is automatically “better” for everyone. Gold bars usually offer lower premiums for larger purchases, while coins provide high recognizability and convenient sizes, so the right choice depends on your budget and how you plan to buy and sell.

Q: Are gold bars cheaper than coins, and why do premiums differ?

A: Gold bars tend to be cheaper per ounce than coins because they are simpler to manufacture and carry less branding and marketing cost. Coins often have higher premiums due to their legal‑tender status, detailed designs, and strong demand from both investors and light collectors.

Q:

Is a 1 oz gold bar or a 1 oz gold coin better for beginners?

A: A 1 oz gold coin is often more familiar and easier to sell, which many beginners appreciate, while a 1 oz bar can be slightly more cost‑efficient. If comfort and recognizability matter most, a coin can be a better first step; if cost per ounce is the priority, a bar may appeal more.

Q:

What is the difference between bullion and numismatic gold coins?

A: Bullion coins are valued mainly for their gold content and track the gold price plus a relatively transparent premium. Numismatic coins carry additional value for rarity, age, and collector demand, so their prices can move differently from gold itself and require more specialized knowledge.

Q:

Are gold coins more liquid than gold bars when it is time to sell?

A: Widely known bullion coins are often among the most liquid forms of physical gold because dealers and investors recognize them instantly. Quality gold bars from reputable refineries are also liquid, but obscure brands or very large bars can be slightly less convenient to sell in small, everyday transactions.

Q:

Can I mix gold bars and coins in the same investment strategy?

A: Yes. Many investors use bars for efficient accumulation of ounces and coins for flexibility and easy resale, creating a balanced gold position that serves multiple purposes. Mixing bars and coins also allows you to diversify your portfolio and manage risk more effectively.

Q:

How do I choose the best gold to buy for my long‑term goals?

A: Start by clarifying your goals (wealth preservation, inflation hedge, diversification), budget, and time horizon. Then weigh cost per ounce, flexibility, and liquidity for bars vs coins, and consider discussing your options with a reputable dealer who can walk through specific products and scenarios with you. Your investment journey may begin with smaller coins or bars and progress to larger bars as your experience and budget grow.

Q:

What are the tax implications of buying and selling gold bars vs coins?

A: Many states have exemptions in their sales taxes for precious metals purchases, but this varies by location. States also differ on whether they charge their own capital gains taxes when you sell gold coins or bars. In the UK, British gold coins like the Britannia and Sovereign are exempt from Capital Gains Tax. Overall, there are not many differences in taxation that specifically target gold coins or bars, so most tax rules apply equally to both formats.

Ready to decide which format fits your plan? Compare gold bars and gold coins in stock today, and if you are still unsure, talk to The Bullion Bank team about the best mix of gold for your strategy before you place your first order.