Silver Investing

Silver investing is an essential strategy for anyone looking to diversify their investment portfolio and protect their wealth against inflation. Silver coins, in particular, offer a unique blend of intrinsic value and collectibility, making them a popular choice among both new and experienced investors. With the growing popularity of online coin dealers, buying silver coins has never been more convenient or transparent. Whether you’re interested in classic bullion coins like the Australian Silver Kangaroo or historic pieces such as Morgan Silver Dollars, there’s a wide range of options to suit every investment goal. Silver bullion coins are not only valued for their precious metals content but also for their potential to appreciate as demand for inflation silver rises. By understanding the fundamentals of silver investing, you can make informed decisions that add lasting value to your collection and help safeguard your financial future.

Market Insights & Smart Buying Tips

In the world of precious metals investing, silver coins often play second fiddle to gold. But savvy investors know that silver offers unique opportunities - especially when it comes to undervalued silver coins. These hidden gems can provide significant upside potential, whether you’re collecting, investing, or doing both. Many investors turn to inflation silver as a hedge against economic uncertainty and currency devaluation, valuing its tangible nature and ability to preserve wealth during times of rising inflation.

In this article, we'll explore what makes a silver coin undervalued, share expert market tips, and highlight top undervalued silver coins for 2025 that deserve a closer look. Silver has a long history as money, serving as a trusted medium of exchange and a store of intrinsic value for wealth preservation.

Types of Silver Coins

Silver coins are a cornerstone of the precious metals market, offering both collectors and investors a valuable asset that stands the test of time. There are several main types of silver coins to consider when building your collection or investment portfolio.

Government-minted coins - such as the American Silver Eagle and the Canadian Silver Maple Leaf - are issued by official mints and carry legal tender status, guaranteeing their weight and purity. These coins are trusted worldwide and often feature iconic designs, making them a staple for both new and seasoned buyers. When evaluating government-minted coins, pay close attention to coin features such as intricate design elements, high purity levels, and authentication features like laser-engraved privy marks. These characteristics enhance the appeal and security of the coins for collectors and investors.

Silver rounds are another popular option. Produced by private mints, silver rounds typically do not have legal tender status but are valued for their pure silver content and often come with lower premiums. They're an excellent choice for those looking to buy silver coins in larger quantities for investment purposes.

Commemorative coins - like the Australian Silver Kangaroo or Morgan Silver Dollars - are minted to mark special events or anniversaries. With limited mintage and unique designs, these coins are highly sought after by collectors and can command higher prices in the market due to their rarity and historical significance.

Why Look for Them?

- Lower entry cost compared to popular high-demand coins

- Potential for significant appreciation over time

- Often include interesting historical or artistic elements

- Useful hedge against inflation and economic uncertainty

Top 5 Undervalued Silver Coins in 2025

Here are five coins that savvy collectors and investors are keeping an eye on this year. Before making a purchase of any of these highlighted coins, be sure to research and compare your options to ensure a confident and informed decision:

1. 1982 Mexican Libertad

- Silver Content: .999 fine silver

- Why It’s Undervalued: Early Libertads have low mintages and strong collector demand, but prices remain modest.

- Market Tip: Look for coins with minimal wear and strong strike-values can jump as collectors seek early issues.

2. 1967 Canadian Centennial Silver Dollar

- Silver Content: 80% silver

- Why It’s Undervalued: Often overlooked due to high availability, but its commemorative status and distinctive wildlife design add appeal.

- Market Tip: Buy certified versions or coins in original mint packaging to increase resale potential.

3. Austrian Silver Philharmonic (Certain Years)

- Silver Content: .999

- Why It’s Undervalued: Common as bullion, but certain years have lower mintages and may gain future premium value.

- Market Tip: Target years with reduced production numbers, or coins in proof condition.

4. U.S. 40% Silver Half Dollars (1965–1970)

The U.S. 40% Silver Half Dollars, minted from 1965 to 1970, are an excellent option for anyone looking to add silver coins to their collection without breaking the bank. Each half dollar contains a significant amount of pure silver, making these coins a valuable asset for both collectors and investors. With a face value of fifty cents, these coins can often be purchased at lower premiums compared to other silver coins, allowing you to accumulate a larger quantity for the same investment. Their silver content and historical appeal make them a smart choice for those seeking to diversify their holdings. When buying or selling these coins, it’s essential to work with reputable dealers to ensure authenticity and to maximize the value of your investment. Adding these half dollars to your collection is a practical and essential step for anyone serious about building wealth with silver.

- Silver Content: 40%

- Why It’s Undervalued: These coins are often dismissed due to lower silver content, but remain affordable and easy to accumulate.

- Market Tip: Buy in rolls or bulk lots to lower your cost per coin.

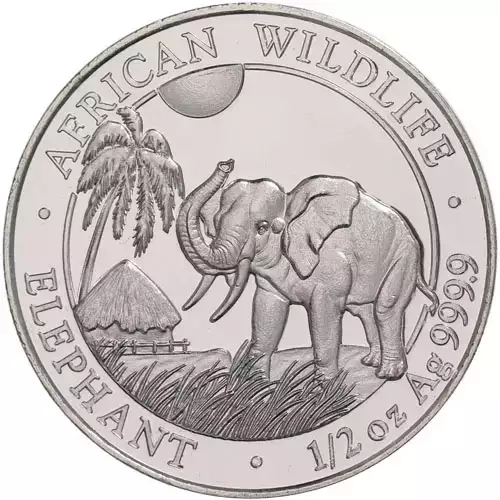

5. Somalia Elephant Silver Coins (Low-Mintage Years)

- Silver Content: .9999

- Why It’s Undervalued: Attractive designs and varying annual mintage make these coins popular in Europe—but still underpriced globally.

- Market Tip: Focus on earlier or low-production years, especially those with limited-edition designs.

Why These Coins Could Appreciate

- Shifts in collector demand for niche and historical coins

- Economic pressures and inflation encouraging silver investments

- Low current premiums, offering strong upside if interest increases

- Growing international awareness of certain regional mint issues

As demand and awareness grow, investors can expect higher premiums on these coins in the future.

Numismatic Value vs. Silver Value

When evaluating a silver coin, it’s important to distinguish between its numismatic value and its silver value. The numismatic value is determined by factors such as rarity, condition, mintage, and historical significance. Rare coins with limited mintage or unique features - like the Walking Liberty or certain proof coins - can command prices far above their metal content due to collector demand. Proof coins often display a cameo effect, where the frosted design stands out against a mirror-like background, achieved through specialized minting techniques such as burnishing and polishing the dies.

On the other hand, the silver value of a coin is based purely on its metal content, typically measured in troy ounces. Coins like the American Eagle, which contains one troy ounce of pure silver, are highly valued for their intrinsic metal content and are often traded close to the current spot price of silver.

How to Spot Undervalued Silver Coins: Market Tips

Identifying undervalued silver coins isn’t just about luck - it requires strategy and awareness.

- Understand the process of selling silver coins, including proper identification and valuation, to ensure you recognize their true worth before making a sale.

- When selling silver coins, always select a reputable buyer to guarantee fair pricing and a trustworthy transaction.

Silver Coin Market Tips:

- Research mintage numbers - Lower mintage often equals higher rarity

- Study auction trends - See which coins are gaining momentum

- Check forums and numismatic groups - Discover under-the-radar favorites

- Look for pricing anomalies - Compare dealer prices vs collector market

- Verify condition and authenticity - Undervalued doesn’t mean damaged

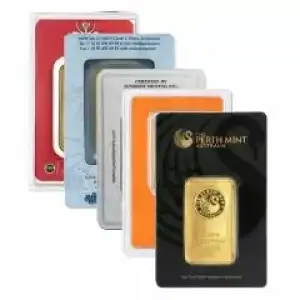

Risk Management for Silver Coin Investors

Effective risk management is essential for anyone investing in silver coins. The silver market can be volatile, and there’s always the risk of encountering counterfeit coins or unreliable sellers. To protect your investment, always buy from reputable dealers, such as those affiliated with the Royal Canadian Mint or the Perth Mint, who guarantee authenticity and quality. Take the time to research each coin’s background, market value, and historical performance before making a purchase. It’s also wise to stay updated on market trends and to verify the credentials of any dealer you work with. By prioritizing due diligence and working only with trusted sources, you can minimize risks and ensure your silver coin investments remain secure and profitable.

Liquidity: How Easily Can You Sell?

Liquidity is a key consideration when investing in silver coins. The ability to quickly and easily sell your silver coins for cash can make a significant difference, especially in a fast-moving market. Coins that are widely recognized - such as the American Silver Eagle, the Canadian Silver Maple Leaf, or coins produced by the Royal Mint like the Silver Britannia - tend to have high demand and can be sold rapidly at competitive prices.

Where to Buy Undervalued Silver Coins Safely

While deals can occasionally be found in person, buying from reputable online dealers like The Bullion Bank ensures peace of mind. Here’s what to look for:

- Clear pricing and transparent premiums - always know what you pay in additional costs or premiums over spot price

- Authenticity guarantees and buyback policies

- Access to both bullion and numismatic options

- Educational resources to guide your investments

- Look for undervalued dimes and quarters, especially pre-1965 issues, as these often contain 90% silver and can offer good value for their silver content

Explore our growing selection of undervalued and premium silver coins at The Bullion Bank.

Conclusion

Undervalued silver coins offer a unique entry point for investors seeking value, growth, and security. From vintage North American issues to hidden international gems, the silver coin market in 2025 presents real opportunities for those willing to dig a little deeper.

Start with a coin or two from our list, do your research, and keep an eye on trends—and you may just find the next big thing in your coin portfolio.