Key takeaways

- Gold and silver volatility is normal: even safe‑haven assets can see large daily moves without breaking the long‑term case.

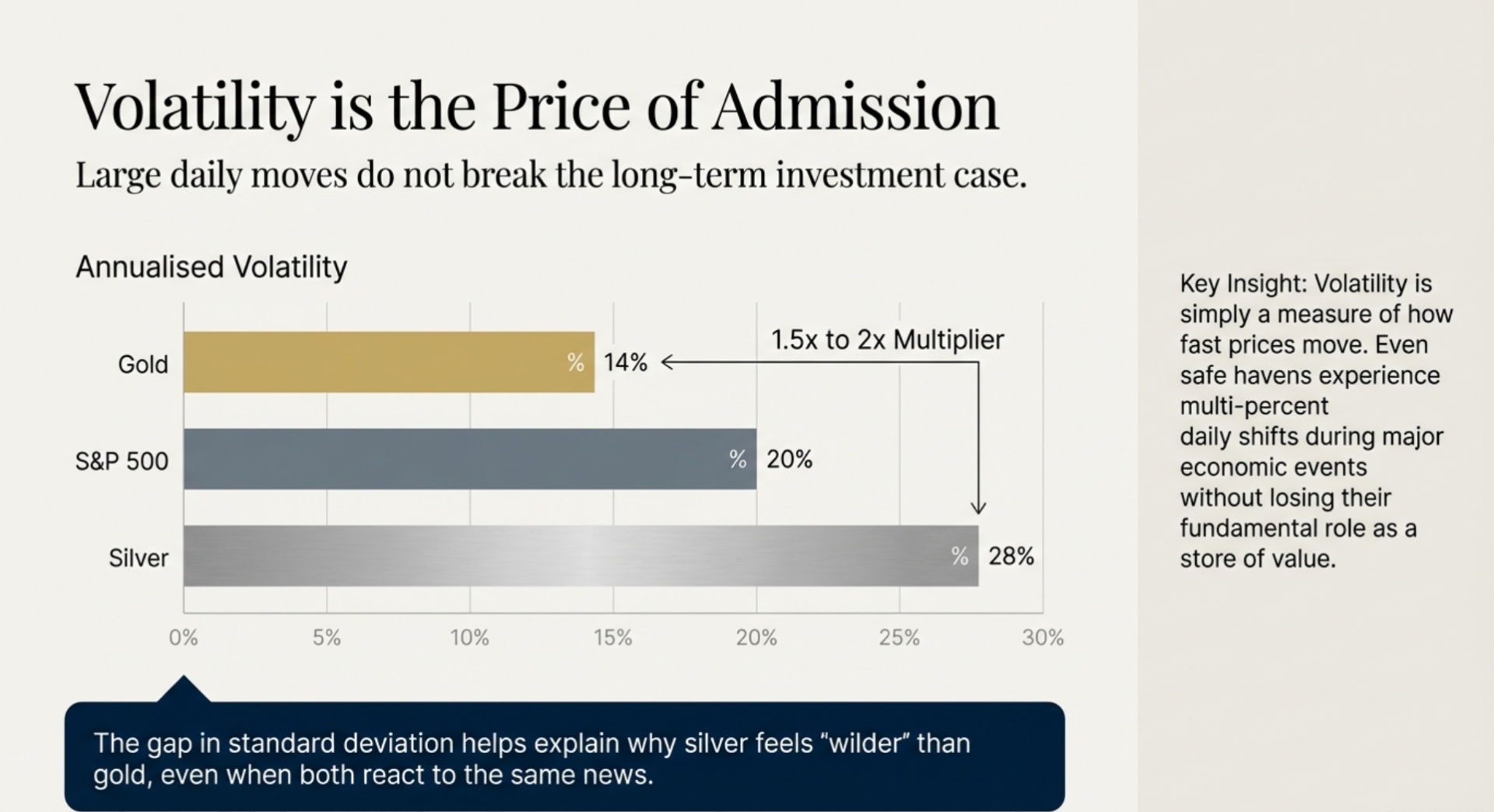

- Over decades, gold’s volatility has typically run in the low double‑digits annually, compared with teens to mid‑20s for stocks; silver’s volatility has often been 1.5–2x higher than gold’s.

- The best response to price swings is a clear plan—set your allocation, pick suitable products, and decide in advance how you will act on big moves.

- Use volatility intentionally: rebalance and add in stages on weakness instead of panic‑selling on drops or chasing rallies.

What “gold and silver volatility” really means

Volatility is how much and how fast prices move up or down over time. Precious metals can see multi‑percent daily moves, especially around major economic or political events, without any fundamental shift in their long‑term role as stores of value.

Historically, gold’s annualized volatility has tended to sit in the low double‑digits, versus teens to mid‑20s for stocks, while silver’s standard deviation of returns has often been about 1.5–2 times higher than gold’s. That gap helps explain why silver feels “wilder” than gold even when both are reacting to the same news.

Why gold and silver prices swing

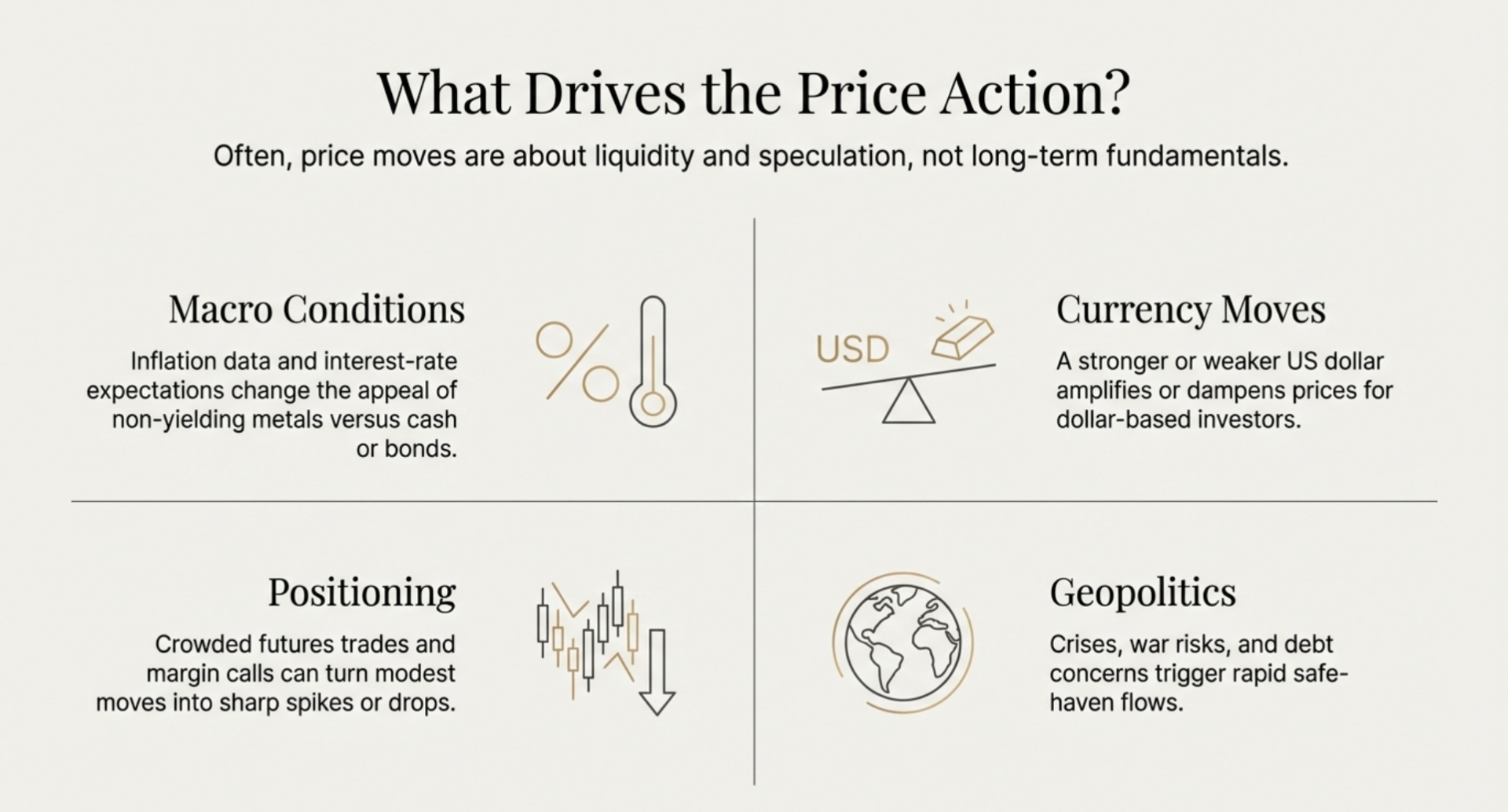

Several forces interact to drive gold and silver price swings:

- Macro conditions: inflation data and interest‑rate expectations change how attractive non‑yielding metals look versus cash or bonds.

- Currency moves: a stronger or weaker US dollar can quickly amplify or dampen metals prices for dollar‑based investors.

- Investor positioning and leverage: crowded futures trades and margin calls can turn modest moves into sharp spikes or drops.

- Safe‑haven demand and geopolitics: crises, war risks, and debt concerns can trigger rapid reallocations into or out of precious metals.

Often, big daily moves have more to do with liquidity and speculative flows than with any sudden change in the long‑term investment case for gold and silver.

Short‑term noise vs long‑term trend

In the short term, gold and silver react to headlines, data releases, and trading flows. Over years and decades, their main job is helping preserve purchasing power, diversify away from fiat currencies, and hedge systemic risks.

That means a one‑ or two‑week drop—even 10–15% in silver or a high‑single‑digit move in gold—says little about whether they still belong in a diversified portfolio. What matters more is why you own them, how much you own, and whether the big structural drivers such as debt, deficits, and currency debasement have truly changed.

How to stay calm when prices swing

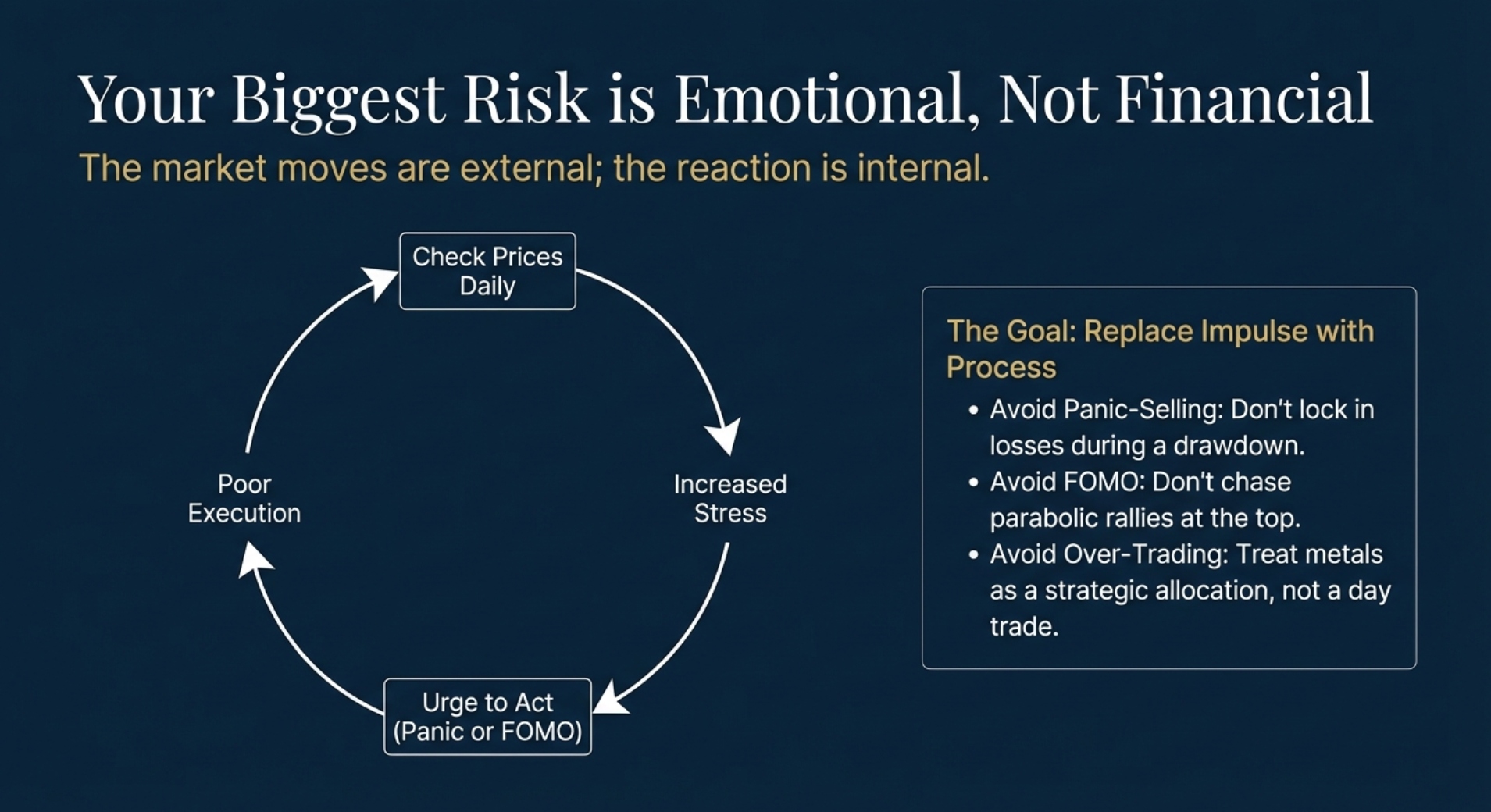

When gold and silver are volatile, your biggest risk is often emotional, not financial. Investors fear they “bought at the top,” panic when prices drop, or chase rallies because they do not want to miss out.

Your goal is to replace impulse with process: know why you hold precious metals, what role they play in your portfolio, and how you will react before the next big move.

Common emotional traps to avoid

Three recurring mistakes during volatility are:

- Panic‑selling into weakness: locking in losses after a sharp drawdown instead of revisiting your time horizon and thesis.

- Chasing parabolic rallies: buying after a big spike due to FOMO, just as a normal correction becomes more likely.

- Over‑trading: trying to catch every short‑term move instead of treating metals as a strategic allocation.

News headlines and social media magnify anxiety because they focus on intraday moves and extremes. A calmer approach is to check prices on a set schedule, focus on multi‑month charts, and view commentary through the lens of your own plan.

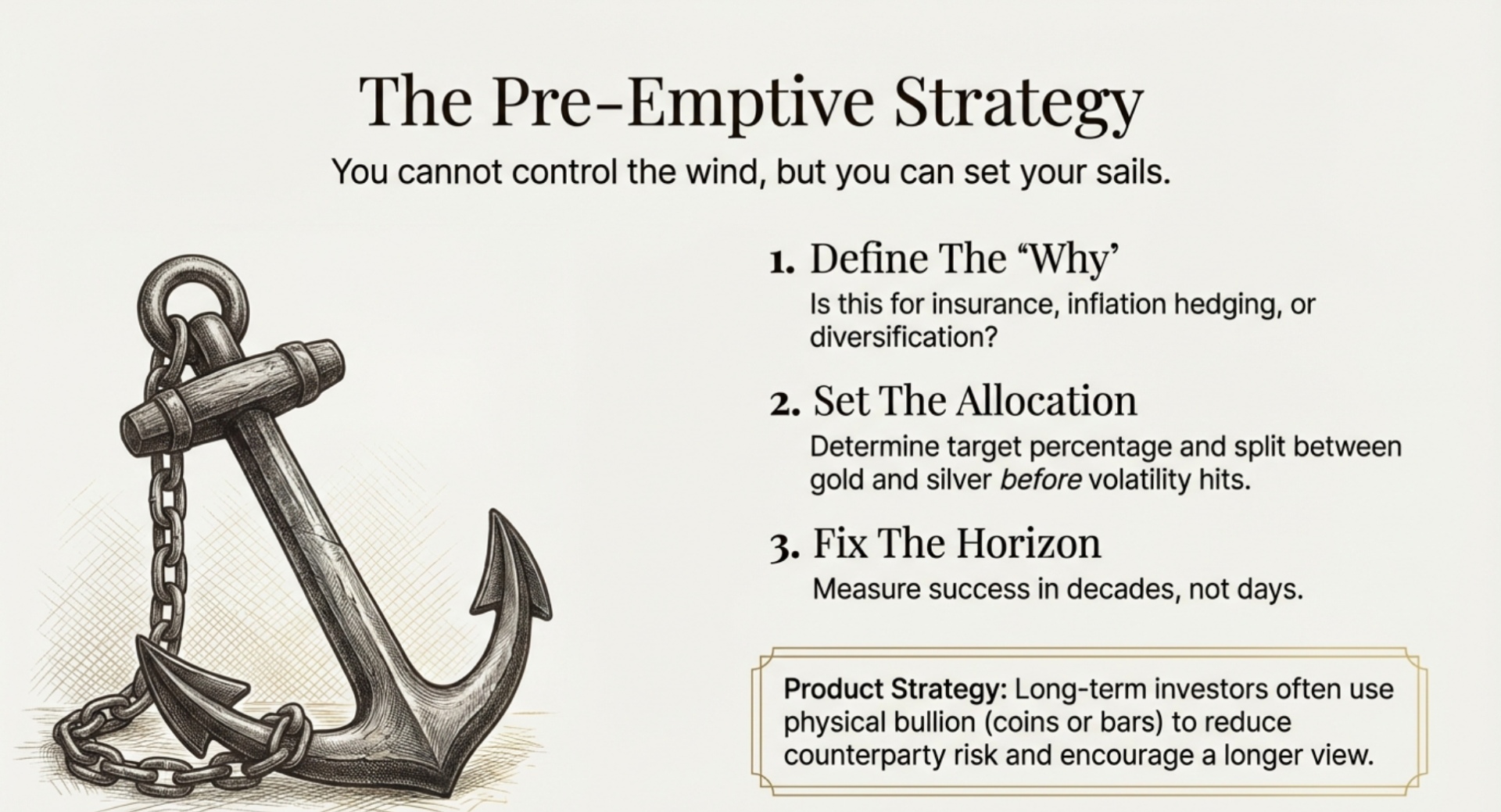

Build a simple precious‑metals plan

A basic plan makes it far easier to stay calm when volatility spikes. It should answer:

- Why you own gold and silver: inflation hedge, crisis insurance, diversification, or a mix.

- How much you want in metals overall and how you will split that between gold and silver.

- Your time horizon—years or decades, not days.

Many long‑term investors use physical bullion—gold and silver coins or bars—as the core of their precious‑metals exposure because it reduces counterparty risk and encourages a longer view. To understand how different bullion options fit various strategies, you can read a dedicated guide on gold and silver as safe‑haven assets.

Practical tips for riding out big price moves

During volatile periods, a few simple rules can keep your decisions grounded:

- Look at your average cost, not the last peak: compare today’s price to your blended entry level, not the recent high.

- Focus on ounces, not ticks: if your thesis has not changed, the amount of metal you own matters more than each price blip.

- Avoid constant monitoring: checking prices several times a day usually increases stress and the urge to act.

- Use a staged approach: commit in advance to add or trim in small steps after defined moves instead of trying to grab perfect turning points.

Should you buy gold or silver after a price drop?

A sharp drop in gold or silver does not automatically mean the long‑term case is broken. In many past corrections, large moves were driven by forced selling and position unwinds rather than by a sudden collapse in fundamentals.

For long‑term buyers, a pullback can be an opportunity if it fits a pre‑set plan and does not push your metals allocation beyond your comfort zone. Buying every dip without a framework can be dangerous if you rely on leverage or concentrate too heavily in a single asset.

When a dip is an opportunity vs a warning

A dip looks more like an opportunity when:

- The big drivers for metals—debt, inflation risk, geopolitical tension—are intact.

- The move is linked to technical factors like margin calls or profit‑taking after a strong run.

- Your allocation is still below your target and you can add without overloading on metals.

It is more of a warning sign when:

- You already hold more gold and silver than planned.

- The drop reflects a genuine structural change, such as a long, aggressive tightening cycle that materially alters the backdrop.

A disciplined rebalancing approach—adding modestly on weakness and trimming after strong rallies—typically works better than trying to time exact highs and lows.

How to invest in gold during volatility

A straightforward process for investing during volatile periods:

- Clarify your goals and time horizon.

- Review your existing exposure and product mix (coins, bars, numismatic pieces).

- Decide which types of bullion you want to emphasize, focusing on widely recognized coins and standard bars for liquidity.

- Work with a dealer that offers clear pricing and a robust buyback policy.

- Implement purchases in stages instead of all at once to reduce timing risk.

To see how metals connect to broader financial goals such as inflation protection and savings, you can explore a dedicated article on using gold and silver to protect purchasing power.

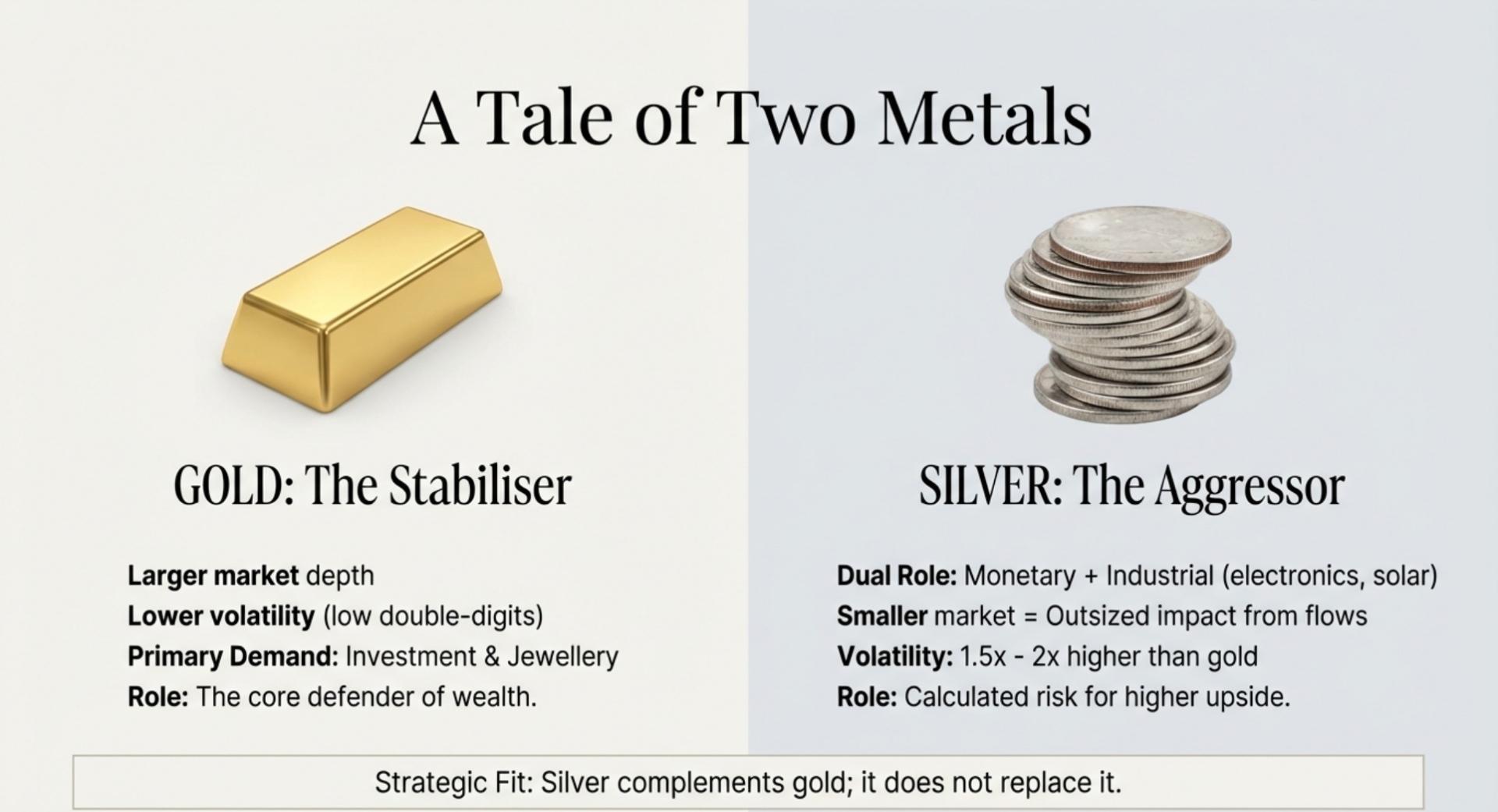

Why silver feels “wilder” than gold

Silver often moves more aggressively than gold in both directions. Over the past 50 years, silver’s volatility has frequently been around 1.5–2 times that of gold, leading to steeper rallies and deeper drawdowns.

Silver’s dual role: industrial metal and store of value

Silver is both a monetary metal and an industrial input. Demand from sectors like electronics and solar panels makes silver more sensitive to economic cycles than gold, whose demand is dominated by investment and jewelry.

Because the silver market is smaller, a given dollar flow can have a larger impact on price than in the gold market. This size difference, combined with heavier speculative use of leverage, helps explain why silver’s price often swings more sharply during the same news events.

Using silver alongside gold

For many investors, silver works best as a complement to gold rather than a replacement. Gold acts as a stabilizing core position, while silver adds measured upside potential with higher risk.

The exact mix depends on your risk tolerance and overall portfolio, but treating silver as a smaller portion of your total metals allocation is common. For a deeper look at how the two metals compare, you can read a side‑by‑side guide on gold vs silver investing.

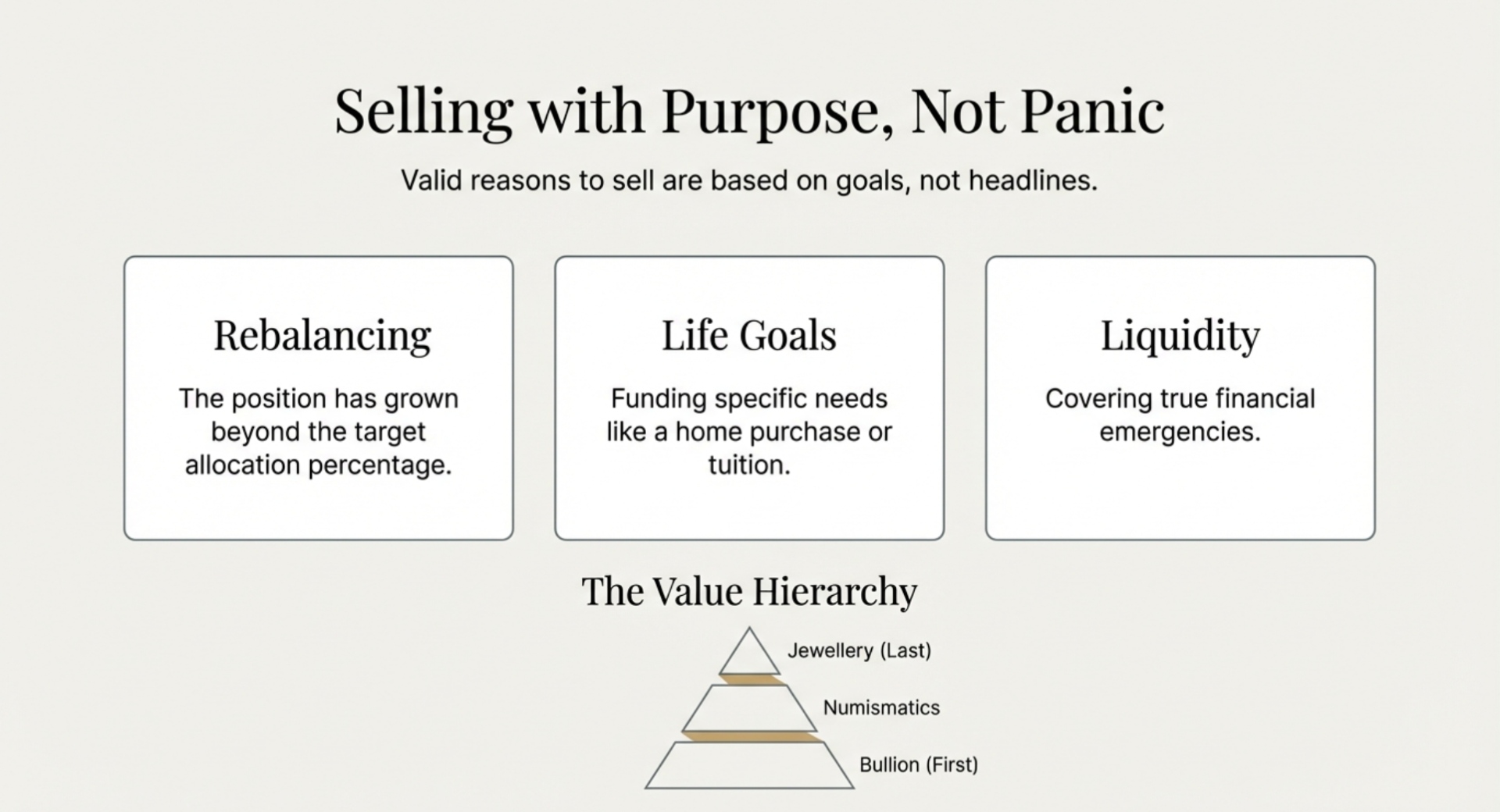

When does it make sense to sell?

Selling should follow a plan, not a headline. For many investors, gold and silver are meant to be held across cycles, with occasional adjustments rather than frequent trades.

Rebalancing, goal‑based selling, and emergencies

Three sound reasons to sell or reduce a position are:

- Rebalancing when metals have grown beyond your target allocation.

- Meeting specific financial goals, such as a home purchase or tuition.

- Covering true emergencies where liquidity matters.

In each case, it is better to define broad triggers and ranges ahead of time so that selling decisions feel like executing a plan rather than reacting under stress.

If you hold a mix of jewelry, numismatics, and bullion, understanding how each category is valued will help you prioritize what to sell first.

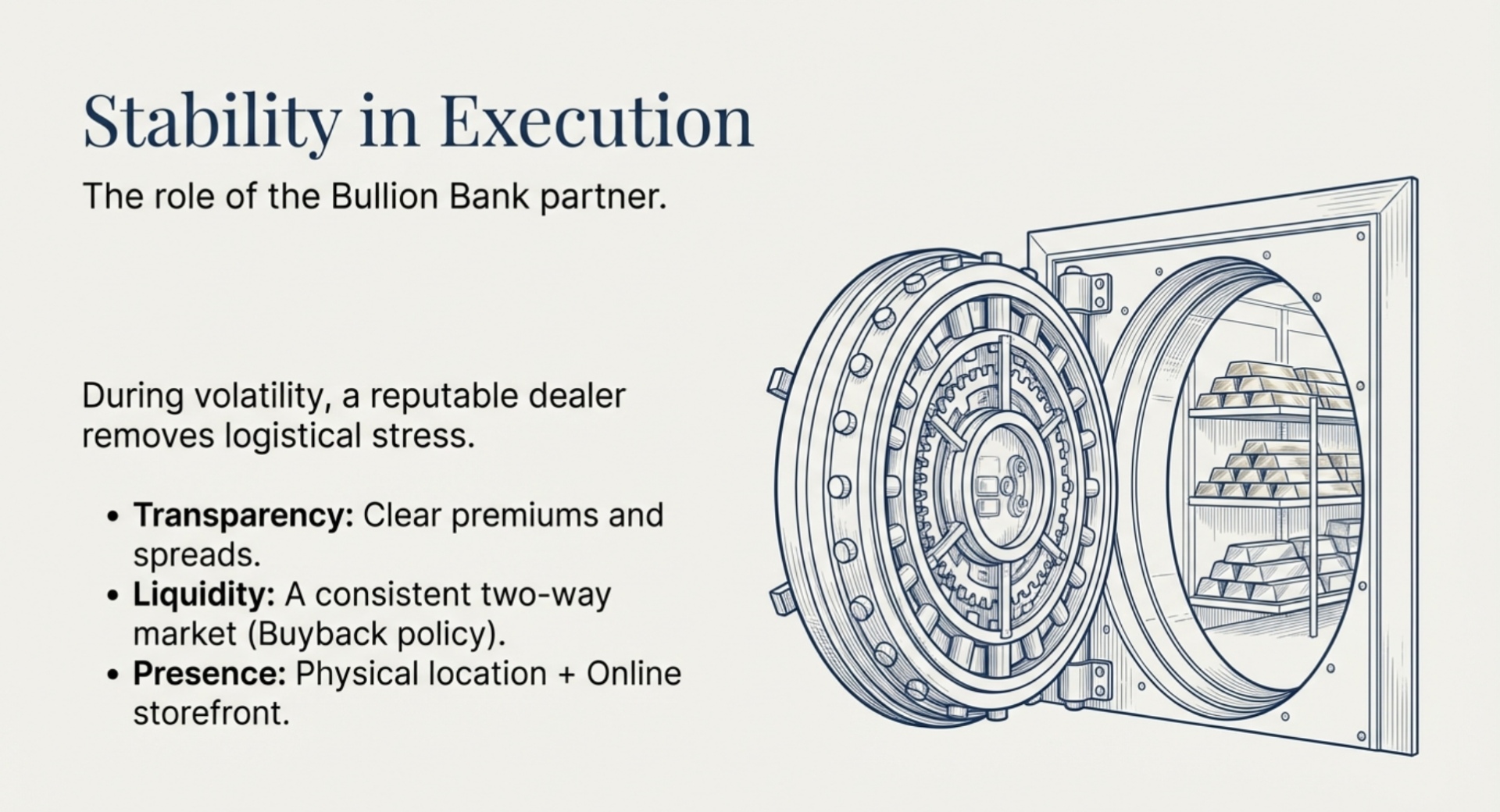

How a reputable dealer helps during volatile times

In volatile markets, the partner you choose can directly affect costs, execution quality, and peace of mind. A reputable dealer should:

- Explain premiums and spreads clearly so you understand the all‑in cost to buy or sell.

- Offer liquid, widely recognized products that remain easy to trade in stressed conditions.

- Maintain a consistent two‑way market and a transparent buyback process.

Working with an established dealer with physical locations and an online presence can help you stay focused on strategy rather than logistics when volatility spikes.

Final checklist: staying calm through the next swing

Before the next bout of volatility, ask yourself:

- Do I know why I own gold and silver and what they are supposed to do for my finances?

- Have I set a realistic allocation and decided how to split it between gold and silver?

- Have I chosen products and a dealer that fit my time horizon and liquidity needs?

- Do I have simple rules for adding or trimming, instead of reacting emotionally?

If you can answer “yes” to these questions, volatility becomes part of the landscape rather than a crisis.

FAQs about gold and silver volatility

Why are gold and silver prices so volatile right now?

They are volatile because interest‑rate expectations, dollar moves, geopolitical news, and speculative positioning are all shifting at once. When traders unwind leveraged positions in thin liquidity, normal news can cause outsized price swings.

Is gold still a safe‑haven investment if the price keeps swinging?

Yes, gold can still act as a safe haven over time even if it is volatile day‑to‑day. Its role is to help preserve purchasing power and diversify a portfolio over full cycles, not to deliver a perfectly smooth path.

Should I buy gold after a big price drop?

You can consider buying after a big drop if your long‑term reasons for owning gold still hold and your allocation is below your target. The safest approach is to buy in stages and avoid leverage rather than trying to time a single “bottom.”

Why does silver move more than gold in the same news cycle?

Silver moves more because the market is smaller, more leveraged, and heavily influenced by industrial demand as well as investment flows. This combination makes each dollar of buying or selling produce larger percentage changes than in gold.

How much of my portfolio should be in gold and silver during volatile markets?

There is no one right number, but most investors keep metals as a moderate slice of a diversified portfolio, not the whole strategy. The exact allocation should reflect your risk tolerance, time horizon, and other holdings, ideally discussed with a financial professional.

Is it better to buy coins or bars in volatile markets?

In volatile markets, many investors prefer widely recognized bullion coins and standard bars because they tend to remain liquid and have tighter spreads. Rare or highly specialized pieces may be harder to value or sell quickly during stress.

Can I sell my gold and silver back to The Bullion Bank when markets are volatile?

Yes, The Bullion Bank maintains a two‑way market, buying and selling gold and silver even when prices are moving sharply. Their published processes for cash‑for‑gold and bullion buybacks aim to keep quotes and settlement straightforward.

Work with The Bullion Bank

The Bullion Bank combines an online storefront with physical locations in Northern Virginia, giving you multiple ways to buy and sell gold and silver during calm and volatile periods. Their team can help you choose suitable bullion products, understand premiums, and structure positions that support your long‑term goals.

Ready for the next price swing?

If you want to turn precious‑metals volatility from a source of stress into a structured strategy, set your allocation, choose your bullion, and define your rules now—before the next big move. When you are ready to act, use a reputable dealer and stick to your plan instead of the headlines.